It’s been a wacky market… and stocks look as if they want to jump off a cliff at these levels. Despite everything the Fed and European Central Bank have tried to do, the market is still getting decimated.

The coronavirus is crippling the global economy, and I just can’t make sense of the overall market right now. If you’ve have trouble uncovering money-making opportunities, don’t beat yourself up… you might just be looking to the wrong areas.

Although the SPDR S&P 500 ETF (SPY) dropped more than 5% and the small-cap tracking exchange-traded fund — Russell 2000 iShares ETF (IWM) — plummeted by 7.75% yesterday, I made money BUYING a stock.

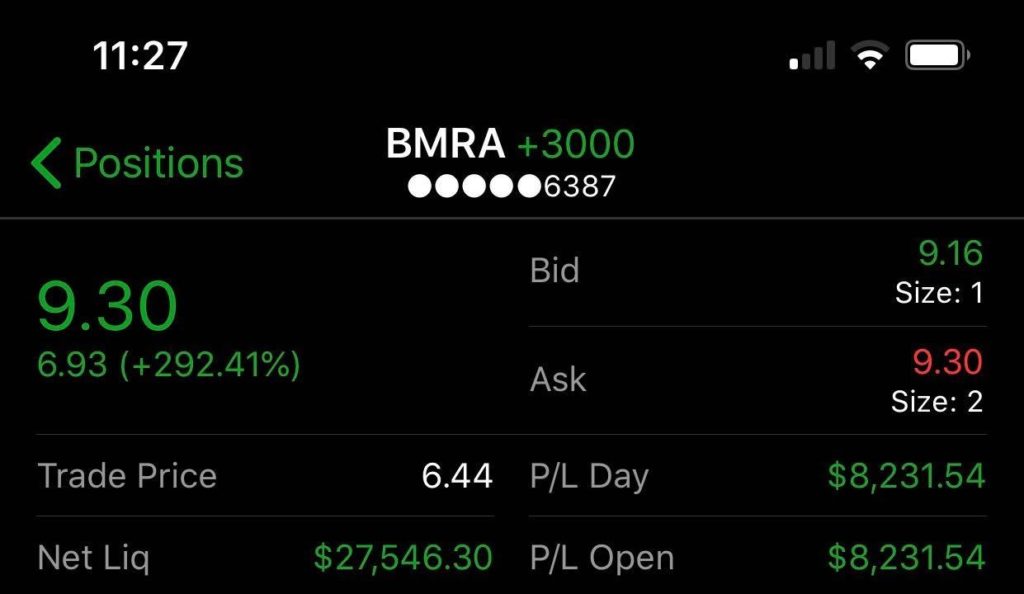

That’s right, just yesterday, I made almost $9,000 in a SINGLE TRADE in less than two hours using one of my favorite patterns.

I don’t normally do this, but in order to help as many people out as possible, I want to prove to you why my trading style is so effective… even when stocks are plummeting.

This information is so valuable, and because I fancy myself an educator above all other things, I thought it was too important not to share with you, too.

For the first time ever, I’m giving you a taste Bond’s Beat — something I only send out to premium members — today!

I know you’re probably wondering, “Jason, how did you spot this massive winner and how can I capitalize on opportunities in this market environment?”

[Leaked] How I Spotted A Near 50% Winner In BMRA

Whenever I alert my clients about a setup and take on a trade, I usually follow up and send out a teachable moment. Nearly everyday, I make take a play based on an intraday bull flag setup… and the wording of the alert is almost always the same.

Typically, it cites a first-day mover on news with heavy volume.

In the case of my massive winner yesterday, Biomerica (BMRA) looked like a juicy setup. On Wednesday, it traded over $273 million, and was number 416 of 8,676 stocks in terms of liquidity for the session.

So earlier today I bought the continuation patten (BULL FLAG) on BMRA at $6.44. It was a nice win and I summarized it with this chart below, after buttoning up about $9,000 profit or just shy of 50%.

Which brings me to …

TEACHABLE MOMENT

When I alert these intraday bull flags — especially on FIRST-DAY MOVERS on HEAVY VOLUME — I almost always say the following, word for word, usually to Jason Bond Picks members: “PROBABLE DAY TRADE, POSSIBLE GAP PLAY”

What I mean by that is… I expect that if this works, I’ll get paid today, and if I get paid today, I might hold SOME of my shares (1/2 or 1/4) overnight for a gap in price action.

Pretty simple, right?

If I win on a trade, I take my profits and let the rest ride, while practicing proper risk management.

Although I didn’t hold any of my BMRA shares overnight, this is a good example of why I usually say that on these setups.

Check out the chart in BMRA below. At 6:28 p.m. ET on Wednesday, the stock was trading at $14.61 — 127% higher from my alert just hours prior.

So let me breakdown this setup:

INTRADAY BULL FLAG: The “flag pole” represents the initial move (in BMRA’s case it was a rally from $2 to $8, seen in the first chart above), and the geometric shape — in this case a rectangle we refer to as a “flag” — is the RESTING PHASE, or the CONTINUATION PATTERN. When I spot this, it usually means the stock is going to continue in the direction it’s going once it CLOSES the pattern.

BUYING OFF THE DEMAND LINE: This means I’m buying shares when they trade at the bottom of the bull flag, or the “demand line,” which is a horizontal support line on the charts.

LOOKING FOR HIGH OF DAY (hod) or SUPPLY LINE: This means I expect the stock to hit the top of the bull flag, or the “supply line,” which is a horizontal line of resistance on the charts.

PROBABLE DAY TRADE: I think I’m right about the pattern and if it works, I’ll likely get my 10%-20% profit today — so no reason to hold overnight, especially when I’m trading shares of small-cap companies that could issue an offering.

POSSIBLE GAP TRADE: This means I see a strong pattern on the stock, and expect it’ll likely run even more tomorrow. Therefore, an after-hours gap up is expected. In most cases I’ll have trimmed my position by 1/4 or 1/2 by the close, in case I’m wrong, so as not to take a loss after being up big into the close.

That said, I was able to lock in a MASSIVE winner just by using that simple, high-probability setup.

It’s good to be back and focused on stock momentum again. I’m locked and loaded, and even in this market environment, I believe I can find better trades. And as I’ve always said, doesn’t matter what market we’re in, there will ALWAYS be breakdowns and breakouts in any market, that’s just how it works.

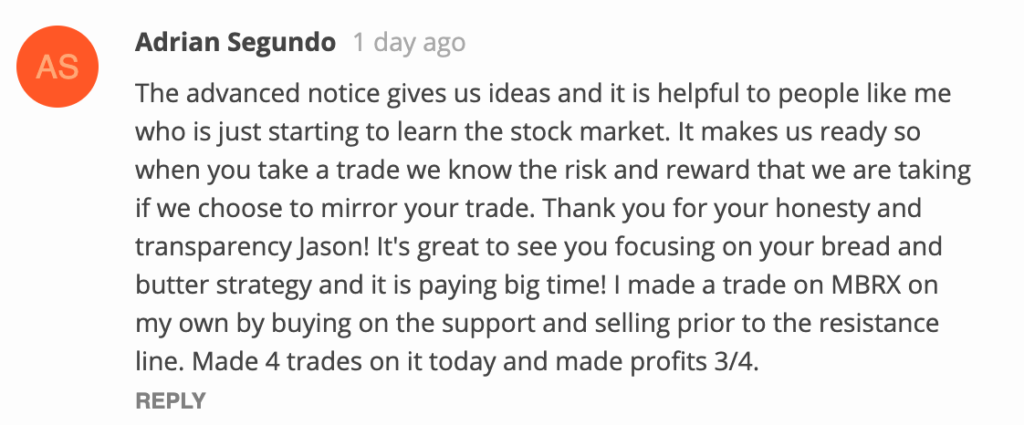

The thing is, I didn’t nail every trade yesterday, but I hope you can see my momentum plays headed in the right direction — and subscribers especially love my BRAND-NEW ‘Advance Alerts,’ where I tell them what I’m going to trade BEFORE I trade it!

They’ve been asking for this for YEARS and now I’m delivering.

Now, it’s been the same thing for 10 years, and trading momentum stocks is how I’ve made it in this game. Since I’m refocused on stock momentum, I’m going to do everything in my power to hunt down as many of these massive winners as possible.

I know it’s a tough environment out there… and I wanted to show you it is possible to make money even when stocks sell off. To address many of your concerns, I’m putting together the most important training event in my career — Jason Bond Picks Unchained.

As a loyal reader, I don’t want you to miss any of the action… and it’s not going to cost you a penny. Click here to watch the replay.

Your advance notice gives a training to those who are new to trading,Please keep up