Swing trading is a speculative activity in whereby stocks are repeatedly bought or sold at or near the end of up or down price swings caused by price volatility. A swing trading position is typically held longer than a day, but shorter than trend following trades or buy and hold investment strategies that can be held for months or years.

Since starting at PennyStockLive in January I’ve swung in and out of several stocks successfully with very few losses. One of them happens to be Majesco Entertainment Company (COOL). They are a provider of video games for the mass market. Building on more than 20 years of operating history, the company is focused on developing and publishing a wide range of casual and family oriented video games on all leading console and handheld platforms as well as online, social networks and mobile devices.

All of my recent COOL trades can be seen here – Jason Bond’s COOL trades

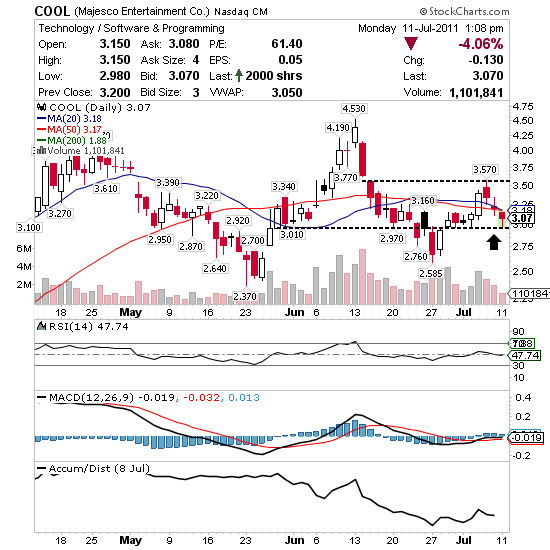

So today I decided it’s time to test the water on COOL again when a bid for over 60k showed up at $3.06 after shares held support around the $3.00 range. I added 10k shares at about $3.08 and with a tight mental stop at $3.06 – $3.00 I’m hoping to see COOL back on the rise into this week. This strategy of buying off support once big bidders arrive works quite often but it’s important to stay disciplined and stop out if the trade doesn’t move away. Basically the idea is good risk reward since support is tight to entry around $.03 per share with upside of about $.50 per share.

There are no immediate catalysts in site with earnings not until September 12th and the Zynga hype a ways off too, but COOL had good earnings last time around with a solid outlook so I expect to see it turn back up as Zynga approaches and earnings draw near.

This is the same strategy I used on LOCM a few weeks ago at $3.33 before it ran almost $1.00 per share on big news with Google just days later. That blog post on LOCM can be seen here.

Technically speaking there is decent support at the $3.00 range with resistance at the 20 and 50 Moving Averages followed by price action in the $3.50 range.

Long 10k COOL at $3.08, current $3.07, goal $3.50, stop $3.06 – $3.00.

0 Comments