Markets are closed today in observance of Independence day, so I thought it would be a good time to pick a question from the AMA prompts.

Today, I found one that I think I can help a lot of traders out there.

The question is: How do you find momentum stocks to trade?

I saw an overwhelming response of traders ask this, and I’m happy to take on the challenge.

At these levels, there’s a lot of action and there are momentum stocks to trade each and every day.

I want to show you my process to hunt these stocks down, as well as provide you with one trade idea.

Revealed: How I Find Momentum Stocks To Trade

My process first starts with scanning for stocks…

Here’s a screenshot of what my scanner looks like.

Source: Scanz Technologies

When I’m looking for momentum stocks to potentially trade, I really care about three things:

- Liquidity

- Whether it’s gapping up or not

- The chart pattern / any catalysts

Now, when most beginners think of liquidity, they automatically think of volume. In other words, the number of shares traded.

To me, that’s not a good measure of liquidity.

For example, a penny stock, say one that’s a nickel, can trade 10M shares a day, but still be considered thin.

Why?

Well, if you think about it in dollar terms… if 10M shares exchange hands on a stock that costs $0.05… that means only about $500K exchanged hand.

In other words, it’ll be hard to get out if I want to have a position worth $25K.

So what’s the better measure?

Dollar volume. In other words, how much money exchanged hands.

For me personally, I look for stocks with at least $2M in trading volume on a given day.

Next, I sort by percentage gain.

I want to find strong stocks that are moving because it actually plays into my patterns.

Now, there are only a handful of patterns I use.

To me, these patterns are easy to use.

This process is what allows me to hunt down momentum stocks.

Let me show you an example of a momentum stock that was sent out to Monday Movers subscribers.

Here’s what was sent on my watchlist on Thursday.

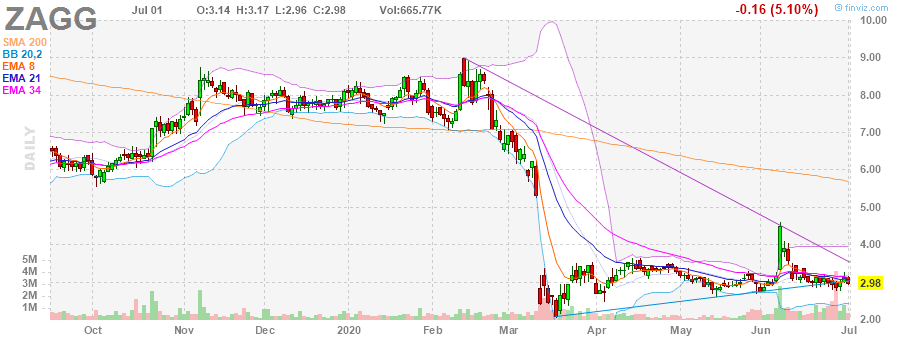

An oversold ZAGG stock has often been a big winner for me. Usually it can be very boring I’ve found, like my GRPN trade above, but has the type of business model that can lead to quick shifts from a downtrend into an uptrend.

I take shots on stocks like this over the weekend because I think a lot of bad news is baked into the share price, so any good news could trigger a bigger than normal move. A lot of times, like my current GRPN trade, I just get bleed out a little, move on and come back to it. But from time to time, like you saw on WATT a few weeks a go, the catalysts trigger and the pop happens. Entry around $3 for me is likely in this dog.

Source: Finviz

Sounds easier than other strategies right?

After I have a stock on my watchlist, I keep it on my radar and look for a clear entry point.

Now, if you want to learn more about my momentum trading strategy, then you’ll want to check out my eBook, Momentum Hunter.

In my exclusive eBook, you’ll learn some of the techniques I use to uncover momentum stocks poised to run… ahead of time.

Claim your complimentary copy here.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services. However, Ragingbull.com, LLC, its owners, and itsemployees may purchase, sell, or hold long or short positions in securities of the companies mentioned inthis communication.

0 Comments