2013 continues to be an excellent year for investors in Gevo (NASDAQ:GEVO). The stock has been rallying since the start of this year on expectations that the biofuel maker will resume production of isobutanol sometime this year.

Gevo shares also received a boost following the extension of tax credits for renewable energy and alternative fuels earlier this year. This week there was yet another positive development for Gevo as the company had a significant win in its patent war with Butamax Advanced Biofuels.

A Major Win

Gevo has been in a patent war with Butamax, which is a joint venture between DuPont (NYSE:DD) and BP (NYSE:BP), for two years now. The patents are related to technology to ferment corn into isobutanol.

Isobutanol can be integrated into existing chemical and fuel products to deliver environmental and economic benefits. Given isobutanol’s potential, lot is at stake for both Gevo and Butamax.

Earlier in the week, Gevo said that a judgement of non-infringement will be entered for it after Butamax acknowledged that the company does not infringe its asserted patents under the court’s construction of a key claim term in Butamax’s Patent Nos. 7,851,188 and 7,993,889. The favourable result for Gevo means that a trial, which was scheduled for April 1st, will not take place now.

An Outstanding Victory

Describing the victory as outstanding for Gevo, Brett Lund, EVP and General Counsel for Gevo, said that the company has consistently maintained that it does not infringe any Butamax patents and Butamax’s concession resoundingly validates the company’s position.

Lund noted that the company continues to demonstrate that it does not infringe Butamax’s patents because it created an NAHD-dependent KARI enzyme that allows yeast strains to produce isobutanol at much greater efficiencies than strains using the NADPH-dependent enzymes claimed by Butamax.

A Big Relief for Gevo

The patent win comes as a relief for Gevo, which has been trying to resume production of isobutanol at its Luverne, Minnesota facility. In September last year, the company had announced that it will halt production of isobutanol at its Luverne facility temporarily and will instead make ethanol in the near term. The decision to halt production of isobutanol and shift to ethanol temporarily had sparked a huge sell-off in Gevo shares. However, since the start of this year, there has been hints that the company is expected will resume production sometime this year. Just this week, the company made a strategic hire for its executive team, which is another sign that it is moving closer to resuming production.

The patent victory, therefore, has come at an excellent time for Gevo. Pat Gruber, Gevo’s CEO said in a conference call with analysts that he is relieved that the first case won’t go on trial, which would free engineers and executives to focus on commercializing the technology. Gruber acknowledged that the trial has been a distraction. He also added that the company plans to resume producing isobutanol this year.

Substantial Legal Costs

While the win is significant for Gevo, the patent war with Butamax, however, is not over yet. Butamax has not conceded that the case is over as the company plans to appeal to Federal Circuit court. In addition, both companies are also fighting over other patents. Gevo has filed a lawsuit against Butamax, alleging that the company infringed on its patents. The trial is scheduled to take place in August this year.

For Gevo, the legal costs related to the trial are significant, especially since the company is not generating any significant revenue. Just last week, Gevo had reported revenue of just $1.9 million for the fourth quarter, down from $17.2 million reported in the same period in the previous year. While the company had initially planned to switch to ethanol production at the Luverne facility, it eventually decided to idle the facility.

The lack of revenue has meant that Gevo has had to use its cash balance, which at the end of 2012 stood at nearly $67 million, to cover the legal expenses related to the patent war with Butamax. This is indeed putting strain on the company. However, Mike Ritzenthaler, analyst at Piper Jaffray & Co., believes that the company has an edge in the legal battle with Butamax. Commenting on this week’s judgment, Ritzenthaler said that it strengthens the company’s hold over technology to prevent bioengineered yeast from making ethanol. The Piper Jaffray analyst currently has a price target of $9 on Gevo and an “overweight” rating on the stock.

The Case for a Buyout

Gevo might have racked up substantial legal costs but at least they won this round. Will DuPont and BP just try bleed Gevo out in court given Gevo’s smaller cash position or put this game of cat and mouse to rest and simply buyout the little biofuel company? Remember, after winning the last round Gevo has indicated it’s going on the offensive in this patent war. Given the cash positions of their competitors, DuPont with $155.86 million and BP with $19.87 billion, Gevo’s recent win and offensive could open the door to buyout talk given the companies tiny market cap of $85.28 million. Not something I’d base a trade on but definitely a possibility.

What Next for Gevo?

For Gevo, it is crucial to start commercial production of isobutanol at its Luverne facility as soon as it can. The victory this week means that the first case won’t go on trial in April. This means that Gevo for now can focus on resuming production at the facility. However, the patent war with Butamax is far from over. And this means, that the company’s legal costs will continue to mount. The key for the company will be to manage its cash efficiently and resume isobutabol production at the Luverne facility this year.

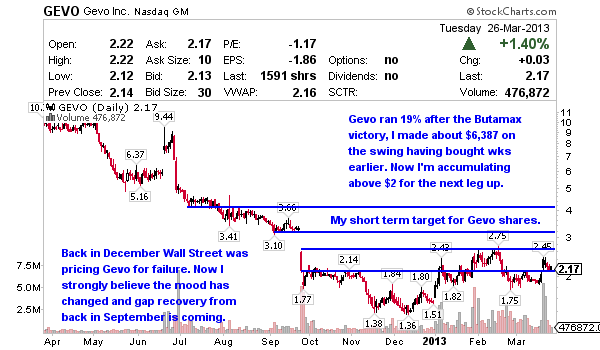

I am long GEVO

now what are thoughts? its at .48 cents

It has the makings of a turnaround story being priced for bankruptcy here. I continue to watch but am not long right now. See how earnings go and then I’ll consider a position after.