Day traders looking for quick returns will definitely be watching BPAX Thursday. BioSante Pharmaceuticals Inc. (NASDAQ:BPAX) is a specialty pharmaceutical company developing products for female sexual health and oncology.

In premarket trade, shares of BPAX has fell more than -75% after the company said its treatment for female sexual dysfunction failed to meet targets in clinical trials.

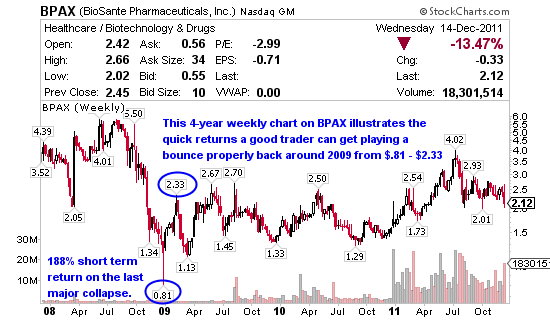

This is a historical low for BPAX at $.50 with the previous low being $.81 back around 2009 and within a month it was up to $2.33.

I’ll probably look to buy a dip after the market opens and see if I can time the bounce properly.

Jason,

As you said, this one was one to ‘watch.’ I watched it go down further from the .50 it was at yesterday and sold it off at .44 for a .06 cent loss. Foolish, but a learning lesson nonetheless.

Ya we sat in chat looking for a dip to buy but it never gave the right signal so we did not enter the trade. Sorry to hear it didn’t go well for you, join us in chat sometime if you can.

I was there this past Tuesday. JohnE1313 was the user name. You answered me a few times when I asked questions.

why can t your website accecpt a canadian e mail address ? i wanted 2 try u out but it said several times 2 provide a proper e mail ?

Our system can take an email address from anywhere in the world so email me at jason@jasonbondpick.com and we’ll get you in there manually if we have to.

Hi Jason,

BPAX is definately good for watch and day trading. But wheather it can have the same return this time compare with in 2009, depending on evently win FDA approval on Feb. If it get CRL on Feb, it will stay long below $ 1.0 or below 0.6.

nonetheless the 0.5 below point is less risk and people bought at this price range should not be panic. it has more chance going up than going down.

I agree Mike, I bought at alerted at $.42 the other day and took 10% but a lot of my guys / gals held for $.50 and made 20% so it’s hard not to lock that in. Moving forward is a bit of a guessing game as you suggested but I agree the risk seems worth the reward here. Had I held my 10k at $.42 there would have been a pretty good chance at double at some point but that’s just not what this newsletter focuses on. Merry Christmas.