The following 7 stocks are below $1 with market caps between $39 and $148 million. Each of them had 500 trades or more Monday and were up between 2% and 15%. While there were over 38 stocks in this filter, the following 7 had interesting charts capable of continuation this week. Coldwater Creek (NASDAQ:CWTR) is the only company with an earnings call this week.

It should go without saying that if a stock is below $1 then it’s going to have a fair share of problems but that doesn’t mean you can’t swing trade it for profit. It’s not wise however to overstay your welcome without doing significant due diligence throughout the course of the trade.

Broadwind Energy (NASDAQ:BWEN) provides products and services to the energy, mining, and infrastructure sector customers primarily in the United States. BWEN’s market cap is $98 million with a book value of $.88 per share.

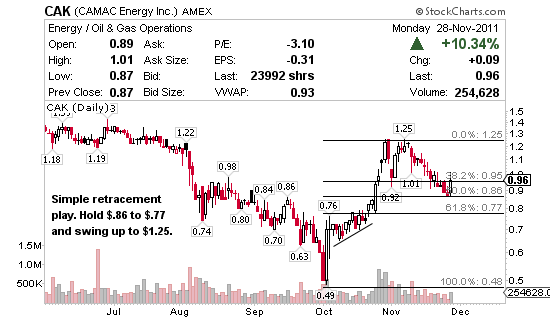

CAMAC Energy (AMEX:CAK) engages in the exploration and production of oil and gas. CAK’s market cap is $148 million and they have a book value of $1.20 per share.

FuelCell Energy (NASDAQ:FCEL) engages in the development, manufacturing, and sale of high temperature fuel cells for clean electric power generation primarily in South Korea, the United States, Germany, Canada, and Japan. FCEL’s market cap is $116 million and they have a book value of -$.13 per share.

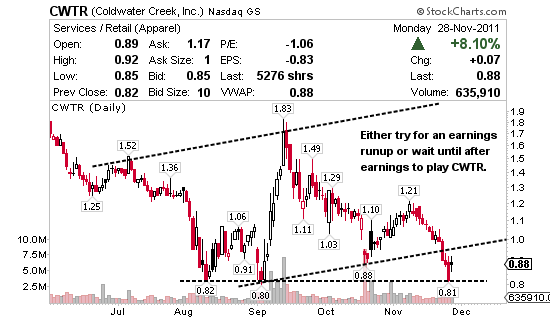

Coldwater Creek (NASDAQ:CWTR) operates as a multi-channel specialty retailer of women’s apparel, accessories, jewelry, and gift items primarily in the United States. CWTR’s market cap is $82 million and they have a book value of $1.47 per share and is scheduled to report their Q3 earnings after the market close on Wednesday November 30, 2011. The recently closed an offering at this level which is why I think it has a chance to go higher from here. Personally I don’t swing through earnings leaving two days to trade before Wednesday’s report.

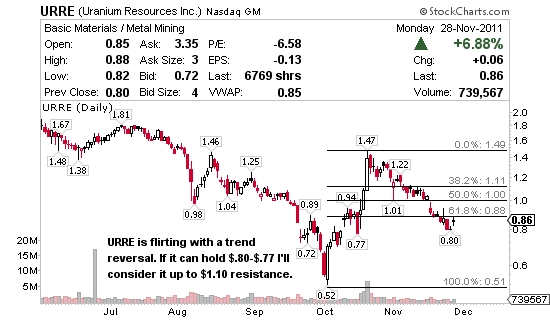

Uranium Resources (NASDAQ:URRE) engages in the acquisition, exploration, development, and mining of uranium properties, using the in situ recovery or solution mining process. URRE’s market cap is $80 million and they have a book value of $.27 per share.

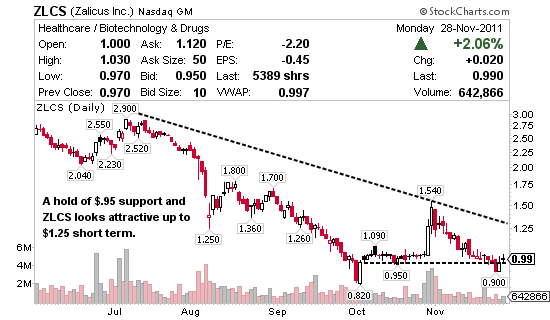

Zalicus (NASDAQ:ZLCS) is a biopharmaceutical company, engaging in the discovery and development of drug candidates focusing on the treatment of pain and inflammation. ZLCS’s market cap is $98 million and they have a book value of $.55 per share.

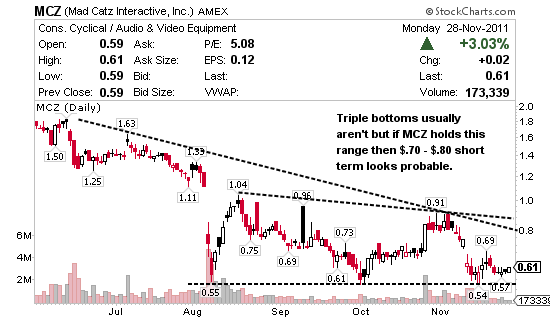

Mad Catz Interactive (AMEX:MCZ) designs, manufactures, markets, sells, and distributes accessories for videogame platforms and personal computers (PC), as well as for iPod and other audio devices. MCZ’s market cap is $39 million and they have a book value of $.43 per share.

50/50 chance of, with black candles and bounce play, to go green with 10-25% gain with market going up and 4 of those stocks are getting attention on lots of sites that day trade.

I’m not sure I get your point Razputan?