The market is heating back up today and the following stocks; KNDI, RENN, PLUG, ARNA and GLUU could all be solid winners in the short term. There are a few strong technical patterns here on KNDI and PLUG and solid catalysts on RENN, GLUU and ARNA. As always, entry is the most important part of swing trading so here is what I’m looking to do.

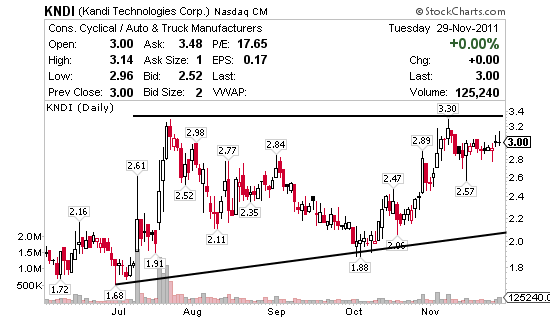

Kandi Technologies (NASDAQ:KNDI) engages in the design, development, manufacture, and commercialization of off-road vehicles, motorcycles, mini-cars, and special automobile related products. The market cap on KNDI is $82 million. While the volume is light on KNDI and outside my normal filter, the chart is what I’m most attracted to here. It shows a strong ascending triangle that could definitely breakout to the $4 range. The price action is not at the apex of the triangle yet though so it might be a little early still. If the company gives traders something to be excited about the reported short interest of over 7 days to cover could help spark a move.

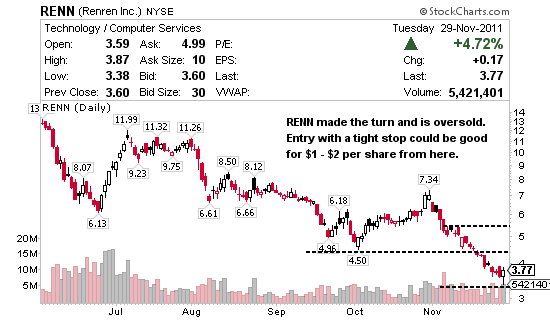

Renren (NYSE:RENN) operates a social networking Internet platform in China similar to Facebook. RENN has a market cap of $1.5 billion which is definitely outside my normal range of $100 – $300 million but I like this stock now that Facebook is promoting their IPO. Recently RENN sold off after less than desirable earnings and a bear market. Now RENN is clearly oversold I’ll be looking to swing this stock for $1 – $2 per share. The short interest here alone could help drive RENN higher if it can hold this turn.

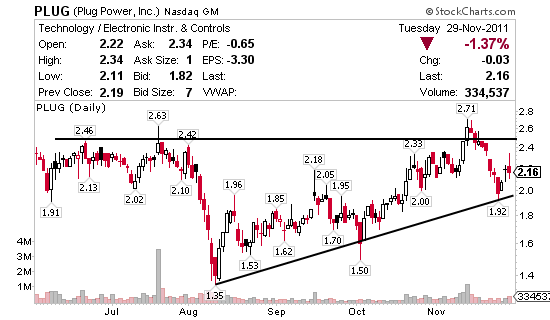

Plug Power (NASDAQ:PLUG) an alternative energy technology provider, involves in the design, development, commercialization, and manufacture of fuel cell systems for the industrial off-road markets and stationary power markets worldwide. PLUG has a market cap of $49 million. I like PLUG off the bottom trendline and like KNDI above I think PLUG wants to breakout. I would not be surprised to see PLUG head into the $3 range in the short term based on this price action. Ascending triangles are known for higher lows with a top resistance area. As those lows get higher the resistance around $2.60 gets weaker and weaker until one day it pops into a new trading range. I played PLUG for profit when it broke $2.40 early November and I’m eying it up again here.

Arena Pharmaceuticals (NASDAQ:ARNA) is a clinical-stage biopharmaceutical company, focuses on discovering, developing, and commercializing oral drugs in the therapeutic areas of cardiovascular, central nervous system, inflammatory, and metabolic diseases. ARNA has a market cap of $210 million. Analysts Piper Jaffray has upgraded ARNA with a target of $3 ahead of their obesity drug NDA re-submission. I tend to agree that we’ll see a walk up soon and like ARNA here off the $1.30 range so I continue to watch for entry.

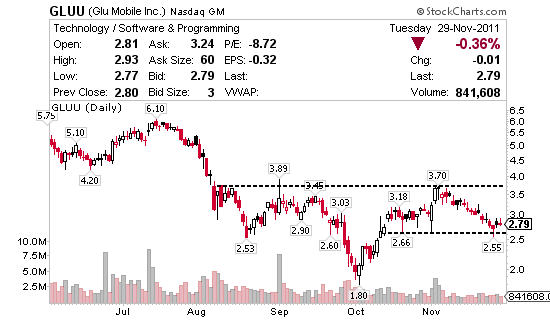

Glu Mobile (NASDAQ:GLUU) engages in the design, marketing, and sale of casual and traditional mobile games worldwide. GLUU has a market cap of $180 million and I believe the recent pullback is simply due to the broader market dip. With Zynga to kick off their IPO roadshow next week I believe there’s a short term opportunity here for at least $1 per share upside before GLUU hits resistance around $3.70.

Hi Jason,

I was in the understanding that you could do this as a beginner trader. I am not sure after watching your webinar lastnight if it is. I thought you signalled when to get in and get out. Are we to be watching these stocks and decide for ourselves when and what to do? I, as I am sure many of us, work full time and can’t be watching the stock screens. Maybe let me know if I am possibly a little or a lot right before I decide what to do. I would be counting on you to inform me of my moves. I have read your quick start and I took it that if you are giving us our stops that would mean you are giving us everything to go with or not to go with. Thankyou for your experience. Your webinar was great, just a little overwhelming for myself. Ida Stadder

Yes Ida I give my buy and sell alerts to all paid subscribers by Skype, text message and email in real-time every week to include the price, size of position, goal and stop loss.