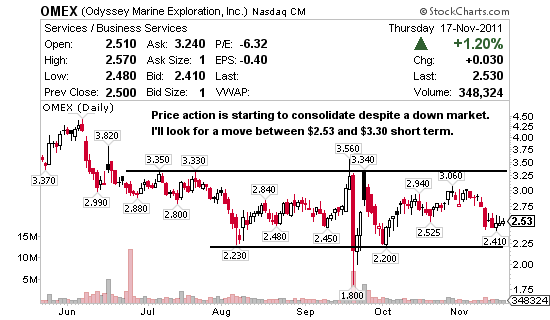

Odyssey Marine Exploration (NASDAQ:OMEX) engages in the exploration and recovery of deep-ocean shipwrecks worldwide. The company has a market cap of $184 million which is in my $100m – $300m target range. The 52 week range is $1.80 – $4.43. Technically OMEX has been roughly trading between $2.20 and $3.30 since July. I like this chart setup a lot, here are my thoughts.

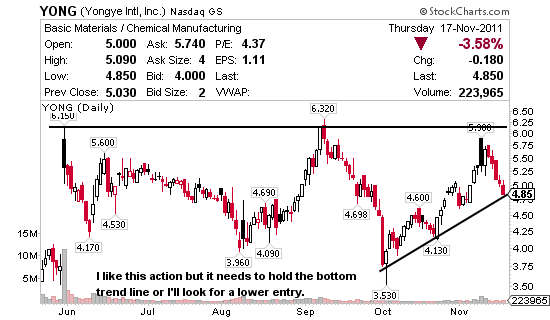

Yongye International (NASDAQ:YONG) engages in the research, development, manufacture, and sale of fulvic acid based liquid and powder nutrient compounds for plants and animals, which are used in the agriculture industry in the People’s Republic of China. The company has a market cap of $245 million and a 52 week range of $3.01 – $8.65. Technically YONG has been roughly trading between $3.50 and $6.50 since March. Below are my thoughts on the chart.

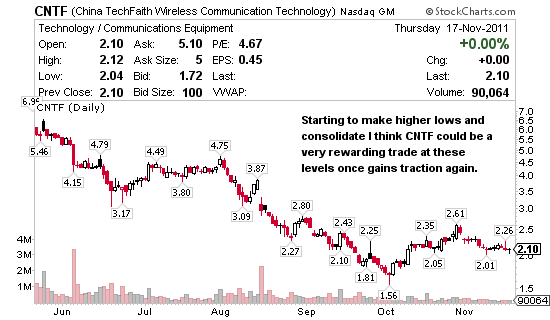

China TechFaith Wireless Communication Technology (NASDAQ:CNTF) operates as an original developed products provider that is focused on the original design and sale of mobile phones in the People’s Republic of China and internationally. The company has a market cap of $92 million and a 52 week range of $1.56 – $6.96. Technically CNTF has been trending down since its May high of $6.96 and represents one of the best opportunities in this list. Let’s take a look at the chart.

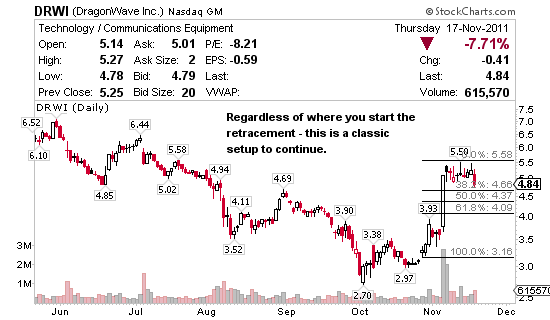

DragonWave (NASDAQ:DRWI) provides wireless Ethernet equipment for emerging Internet protocol networks worldwide. The company has a market cap of $172 million and a 52 week range of $2.70 – $9.20. Technically DRWI has etched a bull flag and is in a consolidation phase right now. Here is what I like about the chart.

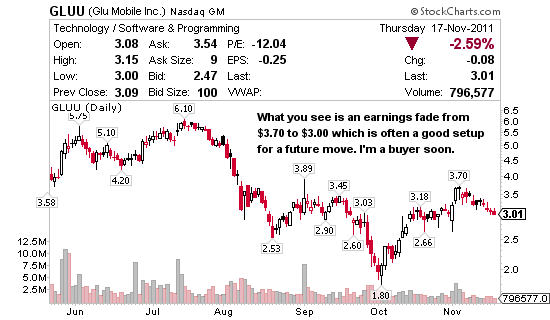

Glu Mobile (NASDAQ:GLUU) engages in the design, marketing, and sale of casual and traditional mobile games worldwide. The company has a market of $190 million and a 52 week range of $1.80 – $6.10. I have traded this stock a lot since starting this service in March, here are my current thoughts on the chart.

0 Comments