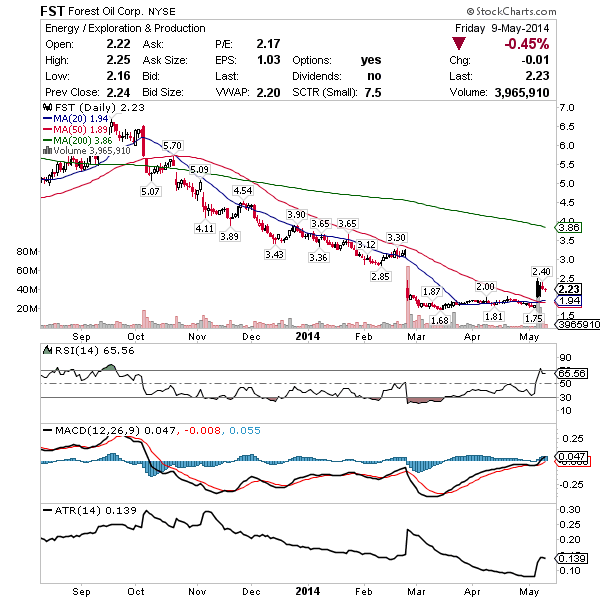

Forest Oil (FST)

Reason for Alert: Merger and Unusual Volume

The announcement of a Forest Oil (FST) and Sabine Oil and Gas merger on Tuesday sent the price of FST soaring $0.30, or 14.8%, on 21.7M shares, or more than three-times the average daily volume. On the following day, the law firm of Harwood Feffer LLP issued a news release, stating it is investigating claims of negligent fiduciary duties of FST’s management stemming from the merger. The newly-merged entity ranks FST as one of the largest players of natural gas in the East Texas region, with estimated reserves of 1.5 trillion cubic feet of natural gas available for future production. Presently, FST produces 345 million cubic feet daily. With 202 institutions holding shares of FST, the company enjoys enormous institution affiliation. Given the controversy, we expect traders to experience some elevated price volatility in the coming days and weeks.

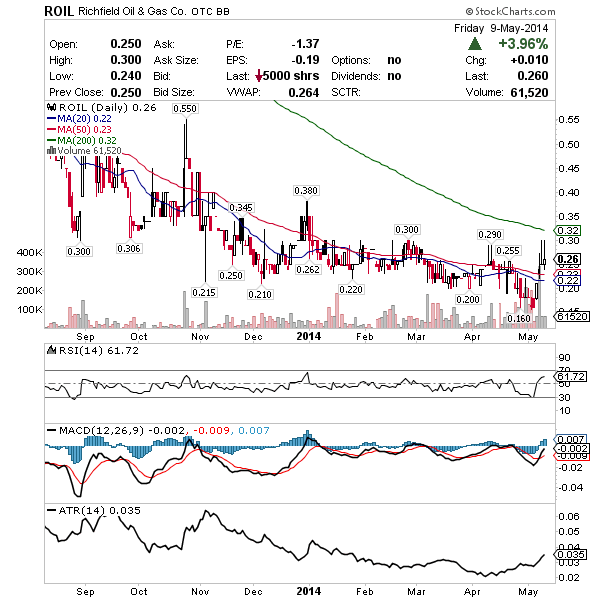

Richfield Oil & Gas (ROIL)

Reason for Alert: Merger and Unusual Volume

Richfield Oil & Gas announced it entered into agreement with Stratex Oil & Gas to merge the two companies. Shares of ROIL jumped $0.03, or 14.3%, on the news. The Utah-based energy explorer recently frac-ed its Liberty 1 well at the Central Utah Overthrust location. The company owns a 51.79% working interest in the well, where in proximity of 65 billion barrels of oil are believed to be trapped in the tar sands of east Utah. Management anticipates that the “massive Mississippian-aged Chainman Shale,” previously analyzed as a potentially lucrative source of oil, will provide significant revenue to the company due to the company’s advanced recovery techniques. Presently, ROIL is the only oil play to find Chianman oil in the Central Utah Overthrust. Other ROIL projects are located in Kansas and Wyoming. With a stock beta of 1.51, we believe ROIL will proved traders with a more volatile experience as the company updates investors regarding the Liberty 1 well.

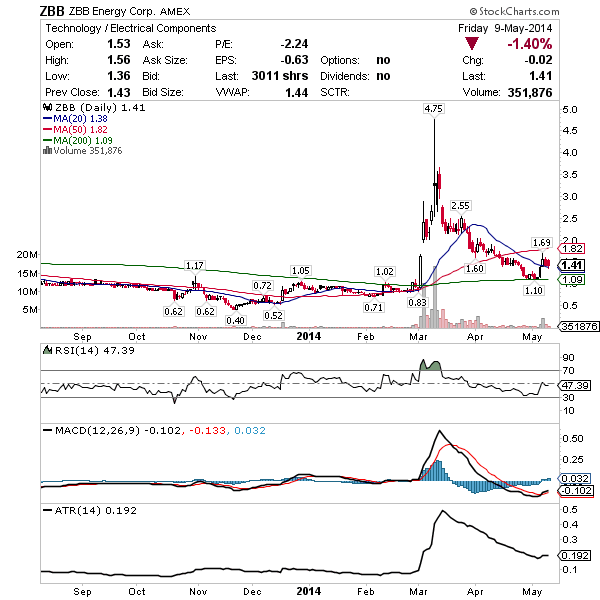

ZBB Energy (ZBB)

Reason for Alert: Unusual Volume on No News; Upcoming Earnings

Shares of ZBB rose $0.18, or 13.1%, on 2.55M shares – on no news. At a market cap of $27.4M and only 16.2M shares of float, ZBB can be volatile as its beta of 2.84 indicates. ZBB’s modular Zinc-Bromide batteries can be used as energy storage for on-grid, off-grid and hybrid configurations. The company had previously announced in early April the completion of a public offering, which the company raised $14.2M for the development and sales of its energy storage and power control technologies. Including $600k in cash, the company has accumulated another year’s worth of cash burn (at the current rate). In an environment of net sales of small cap shares by institutions, ZBB has increased its outstanding shares held by money managers by 1.27M during the past six months, up 28.8% from the previous reporting period. Watch for Q1 earnings to be released after the market close on May 15.

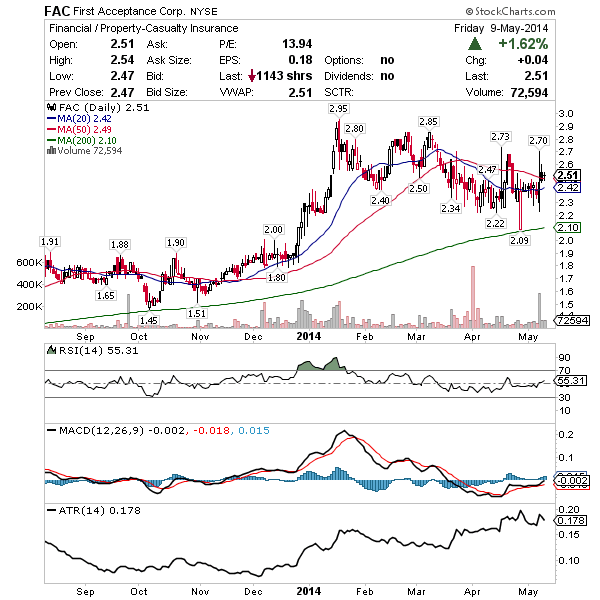

First Acceptance (FAC)

Reason for Alert: Surprise Earnings and Increased Institution Purchases

Shares of FAC jumped $0.10, or 4.24%, on five-times average daily volume, following a better-than-expected earnings report on Tuesday. The TN-based insurance carrier reported a 5.4% increase in revenue of $62.5M for Q1, up from $59.3M of a year ago. Though the company earned a penny per share during Q1, the profit was better than Wall Street expected. With a small float of 32.4M shares and an increase of another 646K shares bought by institutions during the first quarter, the combined total percentage of company shares owned by insiders and institutions has reached more than 80%. At a Price/Sales ratio of 0.40, FAC trades at a discount to the industry average of 0.92. And while the industry as a whole is experiencing a slight decline in Revenue and contracting Gross Margin, FAC has been growing its top line and maintaining a Gross Margin superior to the industry average.

Source: Yahoo Finance

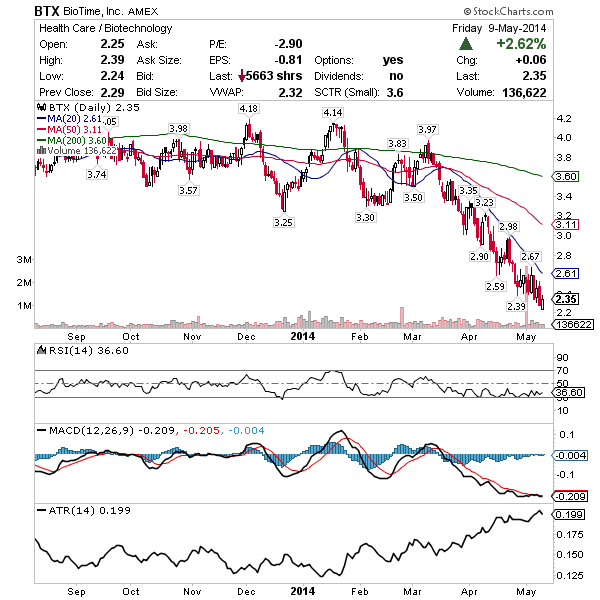

BioTime (BTX)

Reason for Alert: Increased Institution and Insider Purchases

BTX jumped $0.11, or 4.68%, on moderate volume. The regenerative medicine company announced that its subsidiary LifeMap Sciences has launched LifeMap Solutions, Inc., a mobile health products and services company focused upon the applications of LifeMap Sciences’ genomic and medical information technologies. Included in one of the hottest sectors (biotech) on Wall Street, BTX trades at a lofty premium to sales of 30-times. While the company became cash-flow positive for the first time during Q4, the company still reports net losses. However, BTX announced on May 5 a successful capital raise of $6.4M. Additionally, institution purchases exceeded sales during the past six months, and an insider (director) purchased 2M shares ($5.04M) on May 1 at a price of $2.52. As stated in the executive summary of ZBB Energy Corp. (above), institutions have been net sellers of small-cap stocks during the past six months. BTX’s increased institution participation may imply a favorable risk/reward to investors at this time. And an insider willing to initiate a buy order of $5.04M at near market price also suggests confidence in the company’s future value to retail investors. BTX is expected to release its earnings report by May 15.

0 Comments