The follow 5 small caps JOEZ, JAG, COOL, VG and JMBA stock are light volume accumulation plays. None of them have significant short interest, nor do they have any recent insider buying. My favorite market cap is about $100 million with a Beta of 2 or more. If you’re not a client and just visiting my watch list, click here for more like it and read up on my account builders service. JOEZ and COOL are my favorite accumulation plays listed below.

Joe’s Jeans (NASDAQ:JOEZ) designs, produces, and sells apparel and apparel-related products worldwide. JOEZ stock market cap is small just above nano at $69 million with a Beta below 1 at .73. The 52 week range here is $.50 – $1.56 and I find this an interesting play above $1 into the fall with back to school shopping, especially when you consider their recent earnings calls.

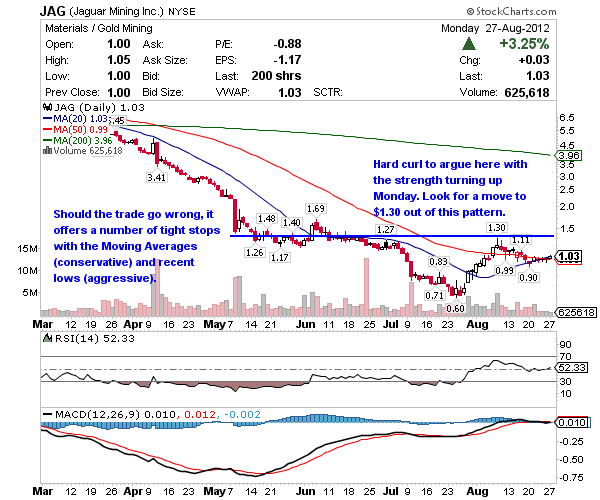

Jaguar Mining (AMEX:JAG) engages in the production of gold, as well as in the acquisition, exploration, development, and operation of gold mineral properties in Brazil. JAG’s stock market cap is $87 million with a Beta of 1.6. The 52 week range is $.60 – $8.18 and recently doubled in less than a month from $.60 in late July to $1.20 in early August.

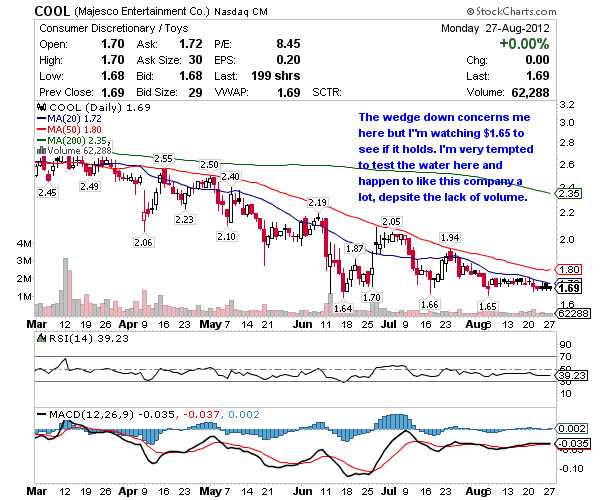

Majesco Entertainment (NASDAQ:COOL) develops and markets video game products primarily for family oriented, mass-market consumers primarily in the United States, Europe, and the PAL territories. COOL’s stock market cap is $67 million with a juicy Beta of 2.12, right in my wheelhouse. The 52 week range is significant here at $1.64 – $3.63 because I believe this small cap is capable of reaching the $3’s again, or a double from down here given the recent development with ZNGA. If they have success with NBA Baller Beats like they did with Zumba this small cap could catch fire again. They have a small stack of cash too or $32 million with $0 debt.

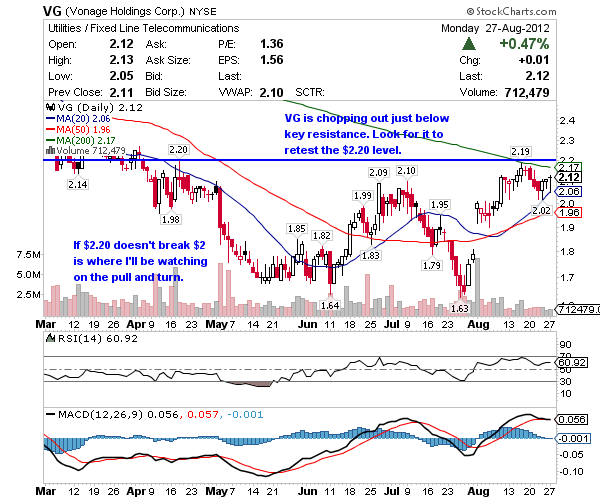

Vonage Holdings (NYSE:VG) provides broadband communication services in the United States, Canada, and the United Kingdom. VG’s stock market cap is the largest of this group so if it gets hot, don’t expect it to move as fast at $480 million with a Beat of 1.74. The 52 week range is $1.63 – $3.67 with key resistance just ahead at $2.20 and if that goes, I think a move to $2.50’s before it’s overbought is reasonable.

Jamba (NASDAQ:JMBA) owns and franchises Jamba Juice stores. JMBA’s stock market cap is $161 million with a volatile Beta of 3.21. The 52 week range here is $1.21 – $2.94 and shares have recently retraced a monster move from $1.94 to $2.94 in July. Given the pullback low of $2.22, a break of the 20 and 50 Moving Averages could bring bigger money back into this trade, especially with the momentum under after profit taking.

0 Comments