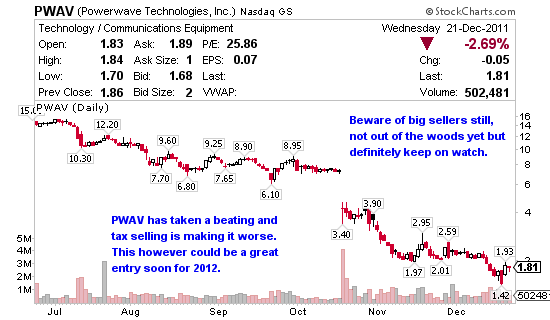

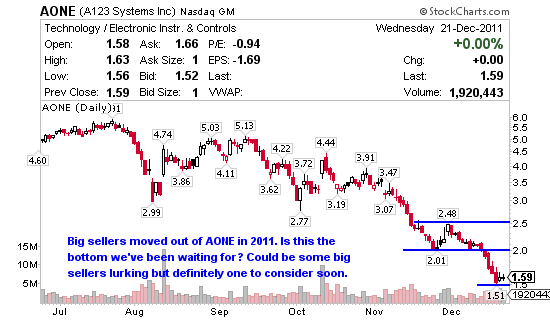

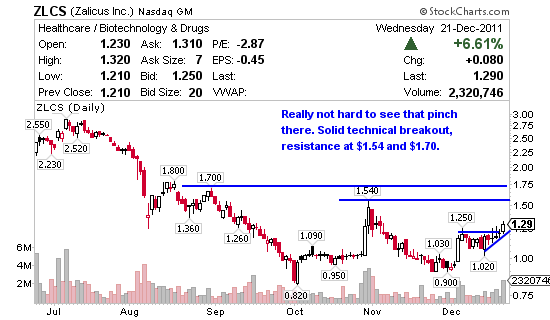

With ten days left in December of which only six are open for trading, two of these stocks PWAV and AONE have been beaten down by big sellers and are positioned to move back up in 2012. The third stock however, ZLCS, is showing a powerfully continuation pattern and appears as if it wants to make a move this week. All of them are possible trades before and after the holiday.

Powerwave Technologies (NASDAQ:PWAV) engages in the design, manufacture, marketing, and sale of wireless solutions for wireless communications networks worldwide. I like this company in 2012 and think it’ll draw the attention of institutions again. I’ll be looking to accumulate shares just above the recent low and see what 2012 brings.

A123 Systems (NASDAQ:AONE) engages in the design, development, manufacture, and sale of rechargeable lithium-ion batteries and battery systems worldwide. Big and I mean big sellers are moving out of this stock. Hard to say if this is the 2011 bottom but you better believe I’m watching close for technical entry. I think AONE could be a steady climber in January and I’d like to be in near the bottom if possible. Be careful though, there could still be some big sellers lurking.

Zalicus (NASDAQ:ZLCS) is a biopharmaceutical company, engages in the discovery and development of drug candidates focusing on the treatment of pain and inflammation. Talk about a continuation pattern, this is a technical masterpiece. Whether it catches or not is the key but right now it appears ZLCS wants to make a move to $1.54 resistance again. With support at $1.25 the risk seems worth the reward and this is a trade I might consider today if big bidders show up.

0 Comments