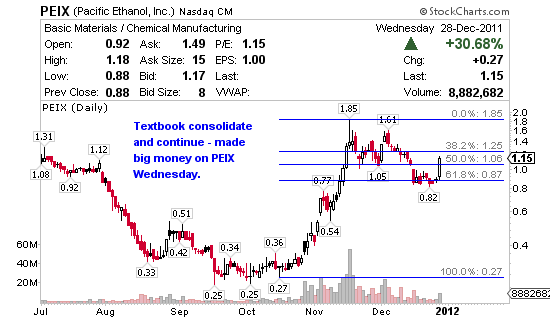

When swing trading continuation patterns I’m looking for stocks that are climbing against the market, have a large short interest and a chart pattern suggesting a sizable move could be right around the corner. It’s important to note some might take several days to develop while others will fade. Watching the 1-minute 1-day chart like I did with my 22% win on Pacific Ethanol Wednesday (NASDAQ:PEIX) is the key to spotting if they’ll become winners of fizzle out. Trades like this can work even if the company doesn’t have news because once they trap shorts you get a lot of added volume to the move. Here’s 10 I picked up on a filter Wednesday evening.

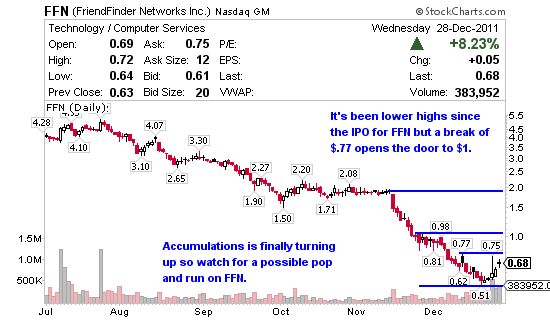

FriendFinder Networks (NASDAQ:FFN) is an Internet and technology company, provides services in the social networking and Web-based video sharing markets. As expected there is a large short interest on FFN at 10.22 days to cover.

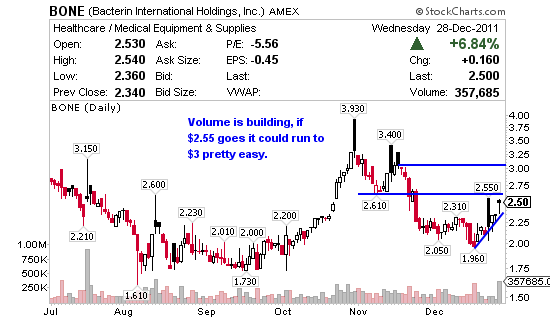

Bacterin International Holdings (AMEX:BONE) develops, manufactures, and markets biologics products in the United States and internationally. The short interest on BONE is 7.78 days to cover.

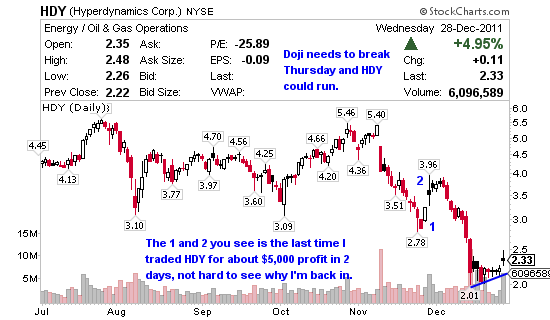

Hyperdynamics Corp. (AMEX:HDY) is an independent oil and gas exploration company, engages in the development of offshore prospects in Republic of Guinea, northwest Africa. The short interest on HDY is 8.67 days to cover. Grabbed some Wednesday afternoon and I’ll probably pick up some more if it continues up Thursday.

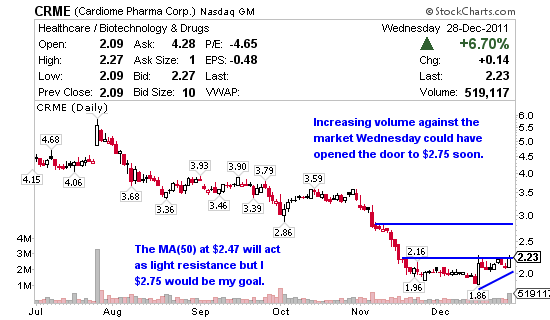

Cardiome Pharma Corp. (NASDAQ:CRME) is a life sciences company, engages in developing proprietary drugs to treat or prevent cardiovascular and other diseases. The short interest on CRME has been declining and is currently 4.09 days to cover.

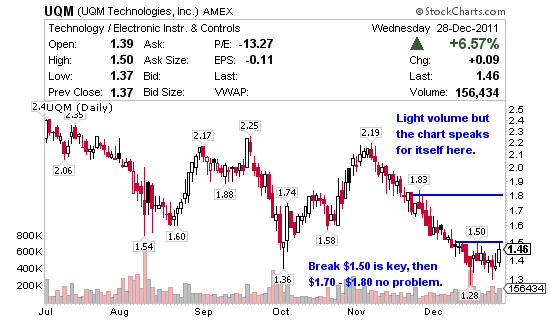

Uqm Technologies (AMEX:UQM) develops and manufactures electric motors, generators, and power electronic controllers. Large short interest here at 12.38 days to cover but that’s down from 18.54 days to cover recently.

Dex One Corp. (NYSE:DEXO) operates as a marketing solutions company. Light short interest here at 2.53 days to cover.

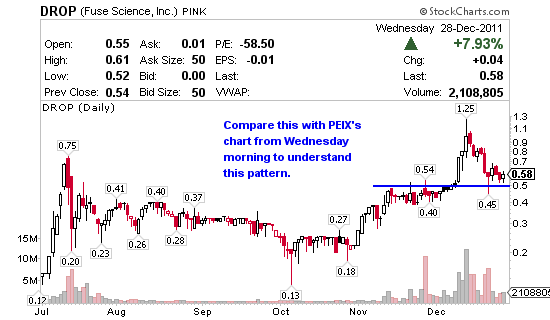

Fuse Science (PINK:DROP) focuses on providing energy and body replenishment products.

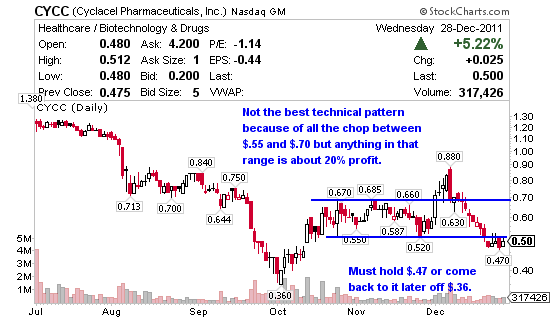

Cyclacel Pharmaceuticals (NASDAQ:CYCC) is a development stage biopharmaceutical company, engages in the discovery, development, and commercialization of mechanism-targeted drugs to treat human cancers and other serious disorders. Short interest is only 1.00 day to cover on CYCC.

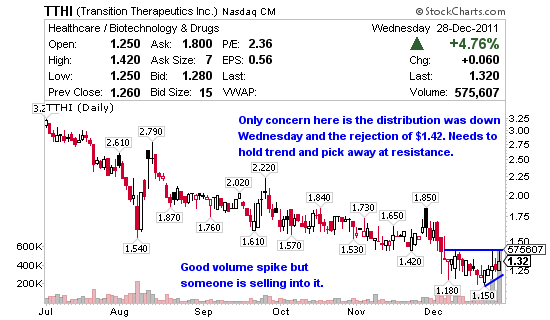

Transition Therapeutics (NASDAQ:TTHI) a biopharmaceutical company, develops novel therapeutics for various disease indications primarily in Canada. Only 1.00 day to cover on TTHI too.

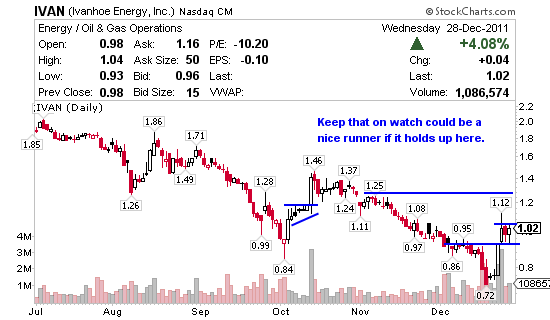

Ivanhoe Energy (NASDAQ:IVAN) engages in the development and production of oil and gas properties. Pretty big short interest on IVAN at 10.21 days to cover although it’s been declining recently.

I am long HDY

I thing if raystream is a company wth no future the stock should be only few cents by now but the ryality is the opposit .rays is steal holding more than 100 %gain so that tell us that this company has some invester like my self belleave that the good years coming because trees whont grow ovrer night hamadi chabouh keep this discution open.

It takes a long time for stocks like RAYS to bottom out and $.0001 but that’s where it’ll probably end up. It’s a scam and you should not drink the Kool Aid. If you’re looking for a real company that ‘might’ eventually have a future and it priced down where RAYS is I’d turn to LQMT. Liquid Metal, while dysfunctional, is real and has a chance of becoming something bigger.

DLGC: I bought some this morning at .91…did you get in?

I’m hoping for a bounce but if it hits the .80’s I should get out?

No sorry Eric I didn’t trade that one. You’d need to sign up for my service to get my real-time alerts.