This morning was filled with whipsaws in stocks, and some traders are having a tough time figuring out exactly what’s going on. To be honest with you, with my momentum strategy, I don’t necessarily need to care what the overall market is doing.

You see, the stocks I want to hunt down for momentum plays must meet strict guidelines before I take them. Most of the time, the opportunities I uncover are in small- and mid-cap stocks — which may not move with the S&P 500, Nasdaq or Dow.

Today, I want to show you how I’m locating opportunities in this environment with a case study in Manning and Napier Inc (MN), a stock that I alerted subscribers about… but sadly didn’t get filled on my order.

What I Do When I Miss Out On A Trade

During the pre-market yesterday, I mentioned to my subscribers that I had an eye on Manning and Napier Inc (MN) for a potential breakout play.

Why was this stock on my radar?

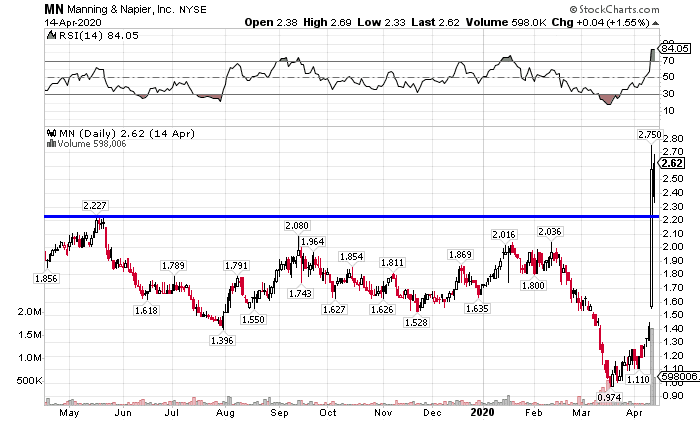

First, there was heavy volume in the stock… and it broke above a key resistance level on the daily chart just two days prior.

Now, on the hourly chart, MN was forming a bull flag/pennant pattern, one of my favorite momentum trading patterns.

Chart Courtesy of StockCharts.com

I figured MN could stay above the $2.40 level and potentially take out the resistance level at $2.75. In the afternoon trading session, I saw an opportunity to buy shares of MN… so here’s what I sent to my subscribers in an advance notice alert.

Strong bull flag setting up just below $2.75 resistance which was the high from Monday. Continuation of this breakout above that level looks likely so I plan to buy around $2.60 for a move to low $3’s if it works, which would be a portion of the initial flag pole which went from $1.40 to $2.75.

Why I Missed The Trade In MN, And What I Could Do Better Next Time

Of course, I didn’t get my fill and MN made a move to $3.25.

So MN was on the watch list as my favorite breakout for the day, and I was right. But due how fast some momentum stocks make their move, there was no way I could chase it and I’m guessing that’s true for many traders as well.

I had a limit order to buy shares of MN, and I just didn’t get filled because the stock shot up.

So what can we learn from this missed opportunity?

First, MN was on my watch list as my favorite breakout, and I write these watch lists to teach from and to give you an idea of the day ahead. In my watchlists, I include my best momentum trading ideas… and I do look to trade them if they get to my price.

In this environment, I think it’s important to have a watchlist just so it’s easier for me to execute once the stock provides an entry for me.

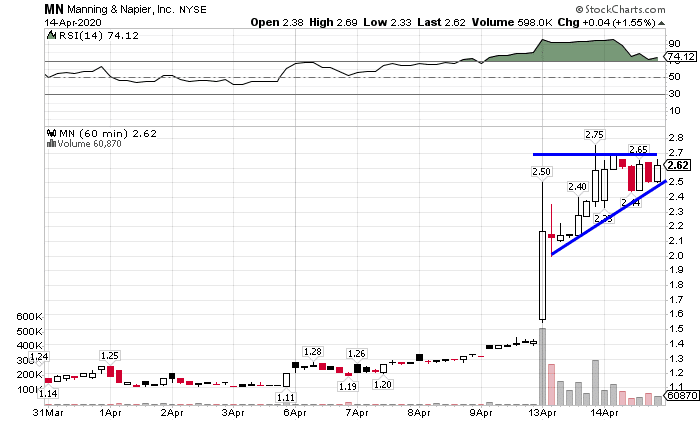

Second, stocks that shoot up and consolidate at the top of the move have the potential to continue the move, usually in the amount of the initial move, as MN did – here’s a look at a screenshot from my phone, it’s the 5-minute 5-day chart.

This is one of my favorite momentum trading patterns, and you can learn how I uncover opportunities using the bull flag/pennant pattern in my brand new eBook.

Just take a look at the monster move MN made yesterday…

Chart Courtesy of StockCharts.com

Between putting it on my watch list and sending advance notice, I missed the move, which will happen from time to time with my new advance notice system, but there’s a lot to learn here because it’ll happen again and if that’s true, then there’s profit out there looming in another breakout.

The key takeaway here is to not beat yourself a whole lot if you miss out on a trade… and I don’t think it’s advantageous to chase momentum stocks because that can make me susceptible to massive pullbacks.

My take is to keep in on a watchlist and continue to stalk potential momentum trading opportunities.

0 Comments