The value of an option contract is based on several factors. They include the risk-free interest rate, time to expiration, the price of the underlying stock, the strike price, and the volatility.

You see, unlike stocks where the only thing that matters is price movement, options are multi-dimensional.

And if you are not taking into account the volatility and time factor, then you are putting yourself at a significant disadvantage.

For example, check the price of these Netflix calls at two different volatility levels (keeping everything else the same):

The value of the $310 call options expiring on Aug 30, 2019, is priced in at $13.92.

However, check out the value of these same options when we change the implied volatility to 45%:

The same call options are now trading at $18.62…that’s a 34% increase in price!

It’s examples like the one above that frustrate the heck out of traders who try options and find no success.

It would happen to me all the time…

That is, until I discovered Weekly Windfalls… A strategy that neutralizes the role volatility plays in the price of an option.

This one simple strategy tweak has taken my options trading to another level:

(My Weekly Windfalls strategy is up and running, I went six for six my first week, scoring $11,000 in trading profits. It’s my first strategy that allows you to piggyback off my trades. Not a member? Join Now)

That said, I’d like to walk you through the mechanics of the strategy. To do that, I’m going to show you a real money case study on an Apple options trade that I just closed out for a winner.

You’ll probably be kicking yourself after you read it, and asking questions like “why haven’t I been trading like this from the start” … I know I am.

Read This Before You Sell Options Premium

Now, you’re probably wondering, What is Weekly Windfalls and how can I get in on the action?

Well, more specifically, I’m looking for ways to collect premium by selling options.

Now, before you start selling options… there’s a bit you need to know.

There have been statistics that prove a lot of options trades expire out of the money. That means traders who sold, or wrote, those options contracts will collect all the premium.

However, I’m not a fan of naked selling calls because your risk can be unlimited (if you naked sell calls)… or massive (if you naked sell puts and the stock drops on negative news… you’d be kicking yourself thinking you should’ve bought some insurance).

Well, I’ve actually figured out a way to stack the odds in my favor by selling options.

How?

I hedge my short options trades. In other words, I have an insurance policy in place.

It’s something known as options spreads.

You see, by having an insurance policy… you’re actually able to “become the casino”…

… and if you know anything about casinos… the house always wins…

… well, most of the time.

Like the casino, you’ll know your risk and reward off the bat. In other words, you know exactly what your max profit and loss are at the start, as well as the breakeven point.

Now, sometimes the risk may outweigh the reward… but that’s okay with me.

Why?

Well, with my Weekly Windfalls strategy, my odds of winning are extremely high…

Heck, the first week since I launched the service, I went six for six (this was just last week).

Now, I’m not expecting to win on every trade… but my win rate will probably be 80% or higher, realistically.

So even if you lose on a few trades here and there… your account should still be up overall.

With that being said, let’s walk through how I use options spreads and locked in $1,600… in just a few days.

What You Need to Know About Options Spreads

Keep in mind, I’m talking about bull put spreads here… but there are a few different ways to set up options spreads (which I teach to my Weekly Windfalls clients).

Here’s a look at the risk profile of the bull put spread (also known as a short put spread or short put vertical spread).

As you can see, your risk is defined with the bull put spread.

So how do you set up the strategy?

Well, you would sell a put at strike price B and buy a put at strike price A. Typically, you want the stock to be trading above strike B.

Now, when you place the short put spread, it means you’re bullish on the stock or you expect it to stay above a specific level.

Typically, I use out-of-the-money (OTM) put options for my spread trades. That means I’m buying puts with strike prices far away from where the stock is currently trading… while simultaneously selling OTM puts with strike prices closer to where the stock is trading.

For example, let’s say I’m bullish on a stock trading at $50… I would sell puts with a strike price of $45, while simultaneously buying puts at $40.

That means if the stock stays around $50 and does nothing… I make money. If the stock has a massive run higher… I also make money. That’s what I’m talking about when I say this strategy stacks the odds in my favor.

All while knowing my maximum risk and reward, so I know if the opportunity makes sense.

You see, when you use a bull put spread… your maximum potential profit is limited to the net credit you receive when you establish the strategy.

On the other hand, your maximum potential loss is limited to the difference between strike A and B, minus the credit you received.

For example, let’s say you established a bull put spread for $1.25. That means for every options contract you sold… you would receive $125. So let’s say you sold 10 put spreads. That means you would receive $1,250.

The strike prices you sold were $45 and $40. That means your max loss would be $3.75 ($45 – $40 – $1.25) per contract.

You also know your breakeven point. Your break-even point is strike price B minus the credit you received.

Remember, even though the risk outweighs the reward… you’ll most likely be winning on most of these trades, so you’ll still be in the green.

Real-Money Bull Put Spread Case Study

I actually used this exact same setup on Apple Inc. (AAPL) the other day.

You see, AAPL was trading above $200 at the time… and I figured that was a big support level.

That means I was expecting AAPL to stay above $200 because there was a high probability that there would be demand if the stock got to that level… which would push the stock back up.

So what did I do?

Well, I sold to $200 strike price puts (the stock was trading right around $205 when I established the position)… and bought the $197.50 strike price puts.

If you look at the AAPL chart… the stock stayed above $200…

… and I actually closed out my position ahead of time. In other words, I didn’t hold the options until the expiration date.

Here’s how the trade turned out.

You can actually do spread trades using other combinations of calls or puts, and calculate your breakeven, max loss and max profit before you get into the trade… and I’m going to provide you with an example of that in a future post.

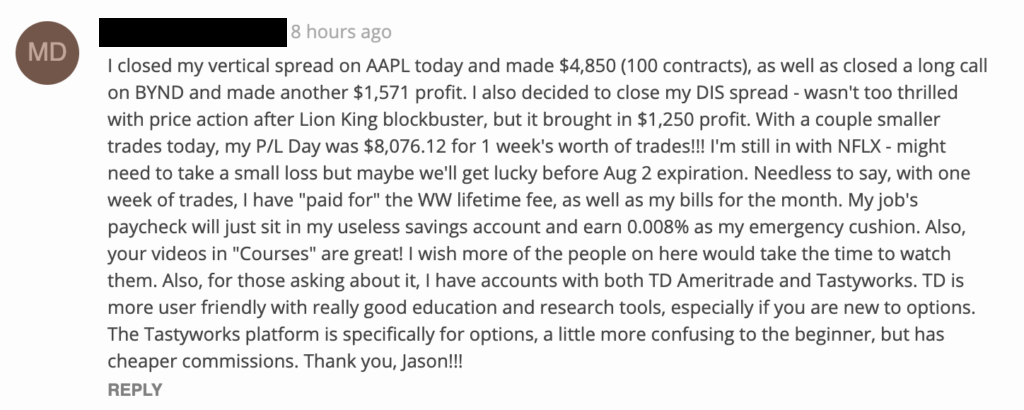

As you can see, spread trades can be profitable… and you can actually “set it and forget it”, if you’re comfortable with the amount you’re risking… just like many of my clients have been doing.

Now… if you are interested in a strategy that provides you with high win rates and high returns… fast, then I invite you to check out Weekly Windfalls and earn while you learn how to use spread trades, receive my real-time alerts, and so much more.

Earn while your learn…..I like that…

excellent review jason