Despite all the choppy price action in the market last week, as stocks bounce around near all-time highs… I was able to spot yet another winner with Jackpot Trades.

That’s a third straight week of Jackpot Trades wins, and if you’ve missed out… I’m sorry to hear. However, I’m confident there are more winners to come, and you can join in on the action.

So what’s Jackpot Trades all about?

It’s simply my highest conviction trade idea of the week… but I don’t discriminate when it comes to making money in the market. If you’re used to buying and holding stocks, or even trading small-cap momentum stocks, you may be leaving profits on the table.

Today, I want to walk you through my most recent Jackpot Trades — in which I locked in a $3,000 winner — and show you one way to minimize your risk while maximizing your profit potential.

[Exposed] How I Spotted A Quick $3,000 Winner In CRSP

Before I get into the details of my $3,000 winner in my most recent Jackpot Trades, I want to give you a crash course on call options (don’t be afraid of the term “call options”, they’re actually really simple to use).

If you haven’t been trading options, you’re missing out on a lot of profit potential. You see, when you buy and hold stocks, for every $1 the stock moves… that’s how much you’ll make.

For example, if you own 100 shares of a stock and the stock runs up by $3, you’ll only make $300. However, options are a different breed.

You see, if the stock runs up… the call options (a bullish bet) could explode. Not only that, but your risk is defined when you purchase call options because the most you could lose is the premium paid.

Let Me Walk You Through How Call Options Work

Think of it like this… Buying a call option is very similar to purchasing shares of a stock.

When you buy a call option on a stock, you’re essentially saying the stock could run up within a certain timeframe. Technically, buying a call gives you the right (but not the obligation) to buy 100 shares of a stock at a specific price (the strike price).

So, if a stock was trading at $100 and you had a 90-strike call, you could exercise that option and scoop up 100 shares of that stock for $90 apiece — a 10% discount to what you’d pay outright.

However, for the most part, few traders that I know use call options to actually buy the shares.

Sounds pretty simple so far, right?

When you use call options, it actually provides you with leverage. Think about it like this, if you want to buy 500 shares of a stock trading at $50 would be $25,000! Whereas a call option — which controls 100 shares of the stock —might be a fraction of that.

If the stock rises above your call strike (yes!), the option is considered “in the money” (ITM).

However, even if the shares don’t go to $50, you can still make money on the trade.

If the stock enjoys a big rally within your timeframe enough to offset any time decay it might suffer — your call option should be worth more than you paid… in other words, you would be sitting on profits.

Then you can close out of your trade by selling the call and pocketing the difference, just like I did with this week’s Jackpot Trade in Crispr Therapeutics (CRSP).

How exactly did I spot this winner?

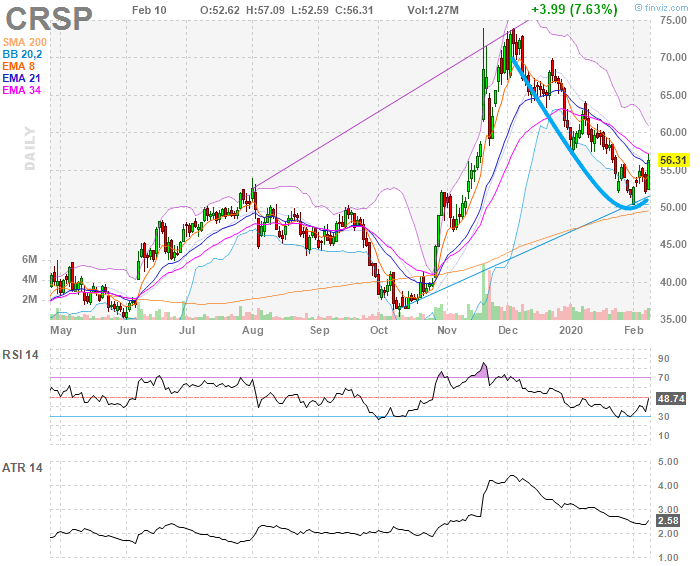

Well, check out the daily chart in CRSP below.

Notice how the stock formed the fish hook pattern… and started to break above the $55 resistance level. The stock bounced off a major support level at $50, and the upswing here had range to the $70 level.

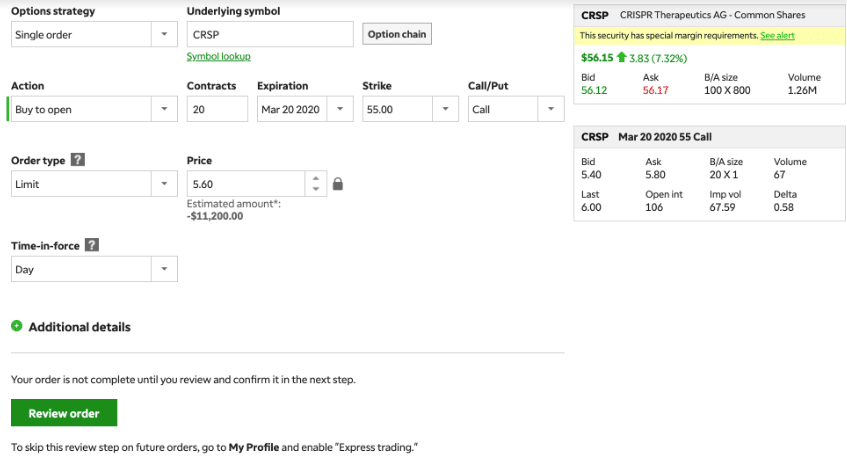

If I were to purchase shares of CRSP at $56.12, it would’ve ate at my capital. So the more efficient way to trade this stock was to buy the call options.

If you look at the number of contracts I purchase and the price, the calls were a fraction of the share price. Now, the reason behind the trade wasn’t just based on the fish hook pattern… in fact, there was a catalyst in play.

CRSP was set to report earnings… and I figured with the run up into earnings, CRSP could continue higher after the announcement.

Guess what happened with CRSP?

The company beat earnings estimates and reported massive year-over-year revenue growth. Not only that but the company noted 2020 has the potential to be a pivotal year. By Thursday, the stock rallied to $60.57.

However, that high print came in the morning session and I wasn’t able to get my sell order off in time. When CRSP came into the $58 – $59 range, I was able to sell my March 55 call options for $7.07 a piece… a whopping $3,000 winner in just a matter of days.

That was a pretty simple trade, right?

Spot the pattern, find a catalyst, and look to the options market to maximize profits. If you missed out on this winner… that’s okay because there are plenty more trade ideas where that came from.

If you want to learn how to simplify your trading with just one trade a week, then click here to watch this exclusive Jackpot Trades training session.

0 Comments