Tomorrow is the start of the first full week of a new month, and I think there will be a lot of action. So much so that some traders may scramble to find potential plays, especially in this market environment.

Heck, even Warren Buffett hasn’t made any big investments amidst the coronavirus pandemic… and I really don’t blame him. It’s tough to read the market at these levels.

That’s why I stick to short-term trading and focus on momentum stocks.

Now, there is a new trading technique I’ve started to implement, and it’s what I like to call my “weekend strategy”. Basically, I find the hottest momentum stocks out there on Fridays and hold them over the weekend.

That way, I’m in a position to potentially take profits come Monday morning.

On Friday, I spotted two momentum stocks poised to gap up tomorrow morning… and after the close of the post-market on Friday, it looks like I may be set for a large return.

Now, I know what you’re probably thinking, “Jason, how does this strategy work?”

[Revealed] The Inner-Workings Of My Weekend Strategy

I’m a firm believer in putting my money to work for me… and if I can find the right momentum stocks for a swing trade over the weekend, I think I have the potential to uncover outsized gains.

Here’s how it works.

I want to wait until the afternoon on Fridays for confirmation and see if my pattern still holds. In order to hunt down these momentum stocks poised to gap up on Monday mornings, I conduct late-day scans.

I want to find stocks that are liquid and are up on the day. To do so, I filter for stocks with a dollar volume ($ volume) of at least $2M… and thereafter, I just sort by percentage gainers.

Once I’ve got a list of stocks to potentially buy and hold onto over the weekend, I look to the chart patterns.

Let me show you how it all works with the previous week’s Monday Movers trade in Sientra (SIEN).

[Case Study] My $4K Winner In SIEN

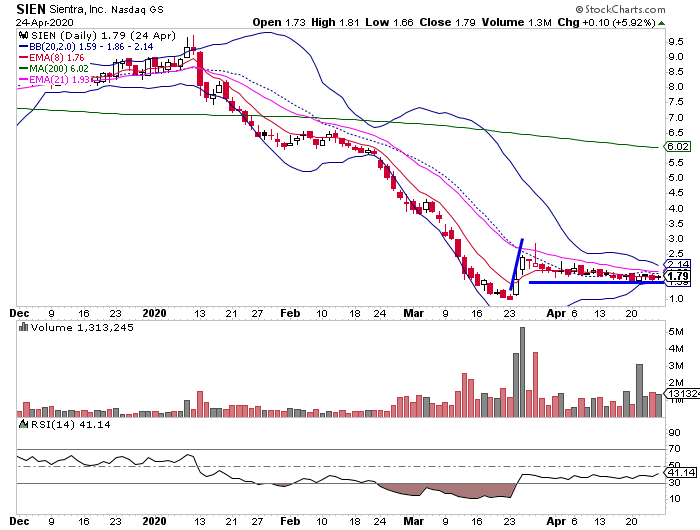

Now, SIEN was on my radar on April 24 because I believed it’s a good company that just had a slew of bad luck recently, at the time. I figured it had the potential to continue higher the week of April 27 based on the continuation pattern after the initial fish hook.

Chart Courtesy of StockCharts

Now, after the fish hook pattern materialized, SIEN pulled back into what I believed to be a support level, right around $1.60 (the blue horizontal line in the chart below).

Chart Courtesy of StockCharts

I figured this was a good time to get into the trade because there was an area of value right around that support level… and it seemed as if buyers were willing to step in around there.

Of course, I didn’t get the move I wanted on Monday… so I had to adapt. I looked at the chart again, and I realized there wasn’t a clear reason for me to get out just yet. I decided to hold onto the trade for a few more days and stop out if the pattern broke.

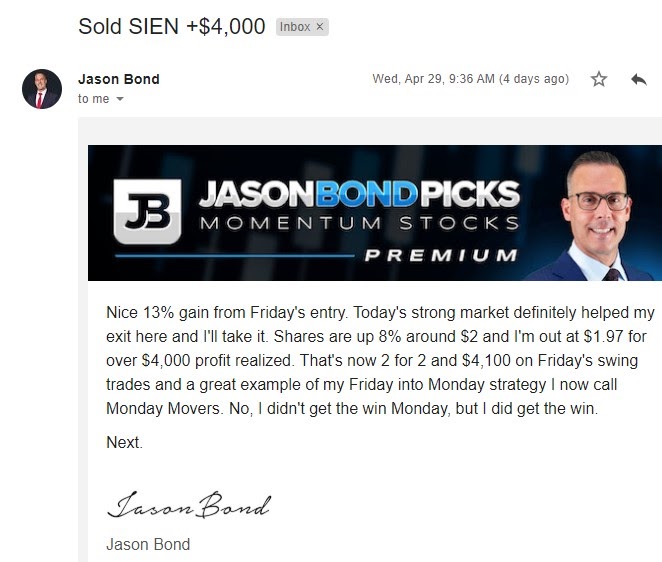

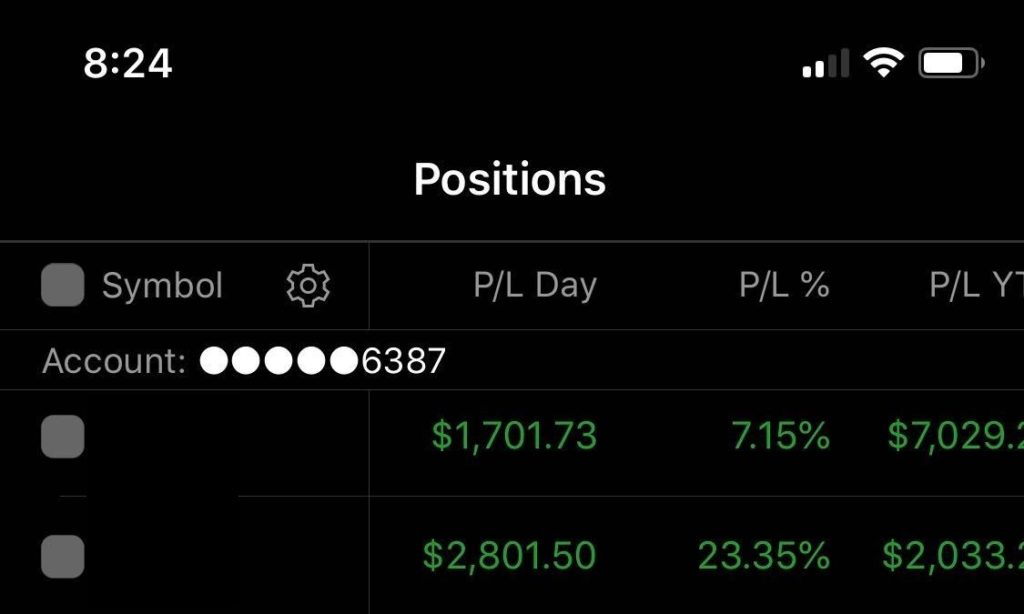

Now, on Wednesday, April 29, SIEN actually made a massive move… and I was able to lock in a $4,000 winner in just a few days.

Here’s the large move SIEN made…

Chart Courtesy of StockCharts

Of course, I had to hold on a little bit longer than expected… but that’s all apart of trading. On Wednesday, SIEN was actually the third hottest momentum stock on my filter!

Source: Scanz Technologies

If I had held longer, I could’ve made more than 5-figures on the trade at the top… but I’m not beating myself up for taking profits.

That’s the power of my weekend strategy. To me, this was really easy to implement… and all I had to do was be patient. Now, if you want to learn why I believe this strategy can be a gamechanger for me, then click here and learn how I find stocks poised to run higher AHEAD of time.

0 Comments