There’s one factor that drives stock prices — supply and demand.

If you remember from any economic class… you probably remember that when there’s more demand than supply…

Stock prices pop.

On the other hand, when there’s more supply than demand, stock prices can drop.

Of course, you might be wondering… How can I figure out the supply and demand?

Well, when it comes to stocks… there’s something known as “float” or “shares floating”. This actually tells us the available supply out there.

How is it helpful for momentum traders?

Look At This Number Before You Trade A Momentum Stock

Floating shares is one of the most important factors when it comes to momentum stocks in my opinion.

Why?

Well, it allows me to gauge the number of shares available to trade. In other words, the supply that’s out there. You see, when it comes to floating shares… the lower the number… the more a stock can move.

Think about it like this… if there aren’t enough shares available to trade and the demand exceeds the supply… what do you think happens?

The price can skyrocket.

I know what you’re probably wondering… What is a good number to look for when it comes to floating shares?

It all really depends on the stock, but anything under 100M shares floating, I would consider a “low float”.

The lower the number of shares floating, the crazier the stock can move to the upside.

Now, if you only want to look for “low floats” there’s actually a simple screen you can look at.

For example, if you head on over to Finviz and hit the “Screener” tab… you can filter for stocks with low floats.

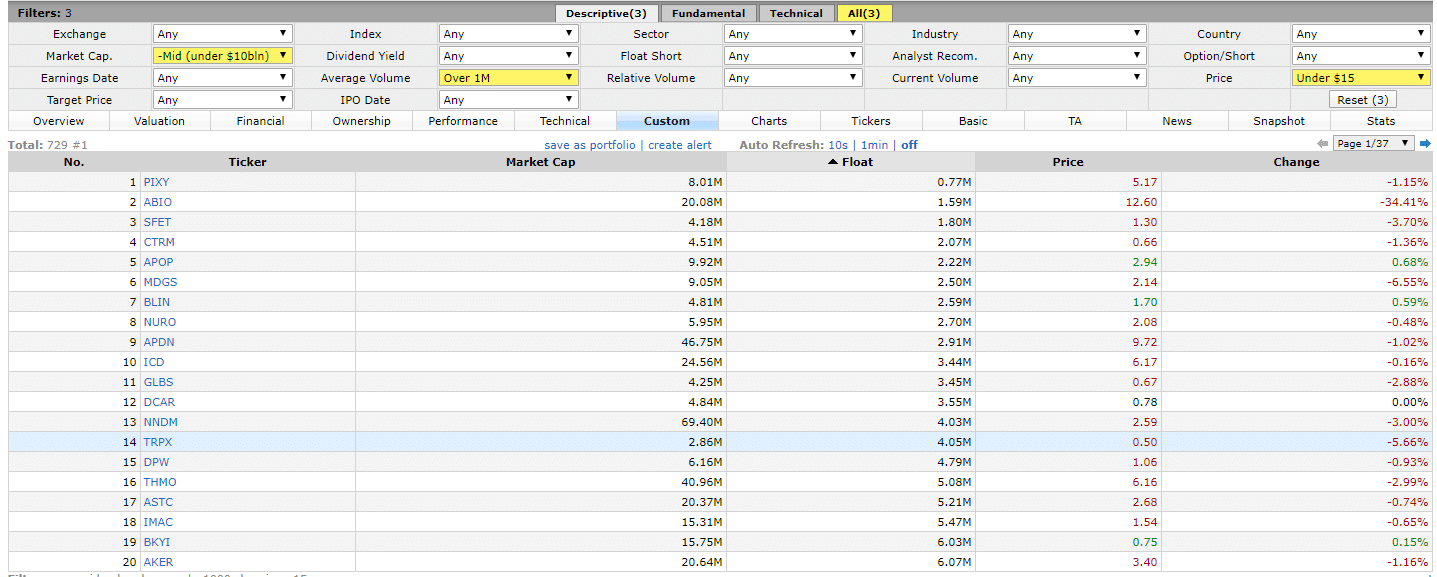

Source: Finviz

If you look at the screen I showed above… I’m filtering for stocks with a market-cap under $10B because I only want to trade stocks that are either micro-, small-, or mid-caps.

I also filtered for stocks with at least 1M in average daily volume, that are trading under $15.

Now, all I did after was sort by ascending order for the shares floating.

This gives me an idea of what stocks have a low float.

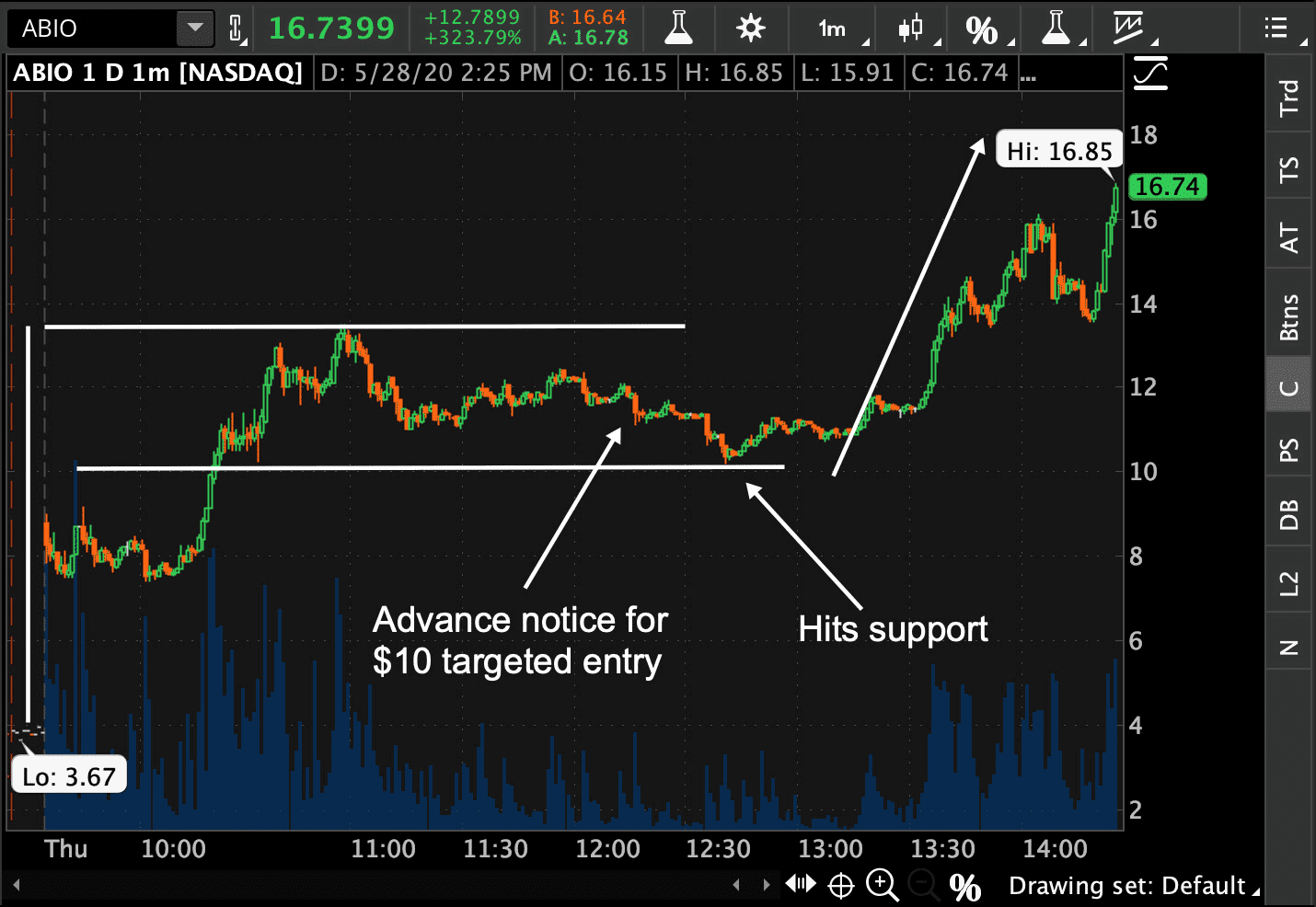

For example, ABIO is second on the list with just 1.59M shares floating… and just look at the monster move it had the other day.

Source: thinkorswim

Now, there’s one low float stock that I’m interested in keeping an eye on next week… which I alerted Monday Movers subscribers about on Friday.

Here’s a look at the note I sent out…

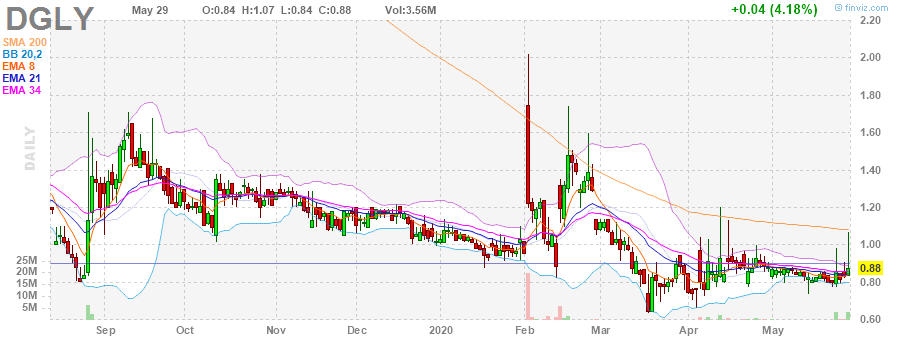

DGLY is my favorite and I’d like to get 10,000 shares between $.90 – $.95 today. My stop loss would be below $.85 and I’d have a goal of $1.50 on the trade if it really caught on, otherwise my standard 10-20%. The situation in Minneapolis is out of control and I think it’s going to build over the weekend, bringing eyeballs back to DGLY which has performed very well in the past when situations like this have arose. The National Guard has been deployed and a CNN crew even got arrested. I think this trade has a pretty good chance of working and might even be a home run.

Source: Finviz

If you look at DGLY on Finviz, the stock only has 11.98M shares floating… and since there was a catalyst in play… the stock made a massive move on Friday.

I’ll be interested to see what happens with the stock come Monday morning… but as you can see, it can be helpful to look at the number of floating shares and pair it with a chart pattern or catalyst to identify momentum stocks set to run.

Now, if you want to learn more about how I’m able to identify momentum stocks set to move ahead of time… click here to gain access to my special training workshop.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

DISCLAIMER: To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer.

good info… thx