Good morning,

And there we have it: 20,000 on the DJIA. The first week of the Trump presidency has been very good for stocks. All-time highs were reached for the DJIA, DJTA, S&P500, NASDAQ, but not for the Russell 2000.

Materials, technology, consumer discretionary and industrials led the charge this month, outperforming the 2.5% rise in the S&P 500 with gains of 6.26%, 4.92%, 4.5% and 3.65%, respectively. Energy, real estate and utilities were clearly the losers, with drops of 1.45%, 0.39% and 0.37%, respectively.

The major stock indexes closed the week as follows:

DJIA: 20,093.78; +1.34%; all-time high

DJTA: 9,444.28; +2.38%; all-time high

S&P 500: 2,294.96; +1.03%; all-time high

NASDAQ: 5,660.78; +1.90%; all-time high

Russell 2000: 1,370.70; +1.39%

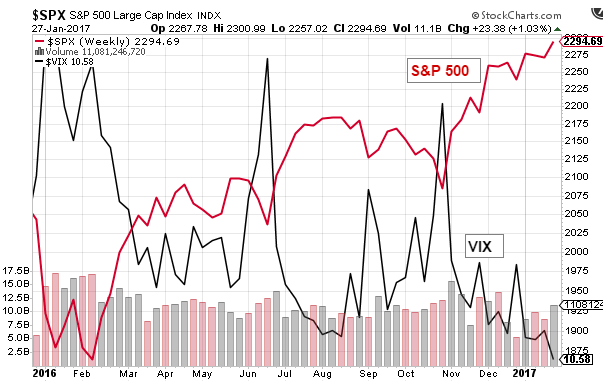

The VIX now stands at an eye-popping 10.58, a level not reached since June 2014. We then have to go back to Jan./Feb. 2007 before we can see a VIX print at this level. By June 2007, trouble at Bear Stearns emerged, which eventually led to a Fed bailout of the broker/dealer in March 2008.

But back then, bad mortgages was the issue destabilizing banks. Today, we have to watch the oil price closely, as the banking system has replaced its speculative practices in the home mortgage market to ‘fracking’ companies.

Recommendation: Follow this link for information about trading the VIX. Later in this report, I have trade for those trading major indexes.

As I would not expect, all-time highs this week in nearly all major averages didn’t come courtesy of significant weakness in the yen and euro. At the close of Friday’s trade, the yen and euro ended the week down 0.42 and 0.03, respectively, with the USD Index barely moving, to close at 100.53. But stocks were strong anyway. How strange.

Who the heck is managing the VIX? Let the “conspiracy theories” begin. As I’ve stated before, following the 1987 stock market crash, the Reagan administration formed the “President’s Working Group on Financial Markets.” a group established to intervene in markets during a crisis. I suspect the “intervention” comes from the NY Fed, whose Exchange Stability Fund (ESF) is intentionally opaque as to its operations and actions. The ESF budget is estimated at more than $100 billion, but who knows how large it really is. But, if I was the NY Fed president and charged to elevate stocks, I’d be active in the futures and options market (VIX), where a fraction of capital needed to move stocks is achievable.

Notwithstanding, as I mentioned last week, if the trend in stock prices is up, you don’t question the wisdom of the trend. No one is smarter than the market, therefore, don’t fight the tape. Right?

Long-term readers know me, in that I never make a call to short a major commodity or major average in a substantive way when the trend is higher, [as] is the case with the oil price for reasons illustrated here. Ditto for stocks, commodities (copper, especially) and the gold market. The trend is higher in these markets until shown to be otherwise.

Well, if you rode last week’s rally, congratulations. If you didn’t, I certainly won’t blame you, especially if you are a long-term investor waiting for an opportunity during a pullback. With a VIX at 10.58, you may not be waiting too much longer, is my guess.

The chart, above, should give you the ‘willies’. In his note of last week, Investor’s Business Daily’s David Chung explains his concern when the VIX reaches such extremes:

At some point, U.S. stocks will indeed cool off. Investor complacency, as measured by the CBOE Market Volatility Index, or the VIX, is dangerously thick, Chung warned. The VIX hit extreme lows at the end of 1993, the end of 2006 and the spring of 2011, and each time the indexes staged sharp corrections of 20% or more.

Hmm. Okay, here’s a trade you may want to consider. How about buying the VIX (VXZ) and shorting the SPY? Take the amount of the stake you want to play for this trade. As an example: $1,000. Instead of going long $500 on VXZ, and short $500 on S&P 500 (SPY), we should adjust for volatility to capture our intended play on the two ETFs narrowing.

Let’s do the math to account for differences in volatility between the VXZ and SPY. The SPY has an implied volatility of between 0.52% and 0.62% (see Finviz.com), while the VIX has an implied volatility of between 1.30% and 1.57%. If we take the average of each of the two volatility metrics, we come up with 0.57% and 1.435%. We, next, find the ratio between the two volatility metrics by dividing 1.435%/0.57%. The result is: 2.52. Take our hypothetical stake of $1,000 and divide by 2.52. The result is: $396.83. That’s the amount with which you go long VXZ, leaving $603.17 ($1,000 – $396.83) remaining to short SPY.

If you want to account for volatility differences between two ETFs (or any other highly negatively trading securities), that’s the calculation process you must make for a good and balanced spread trade.

Okay, back to my observations of this week’s market action.

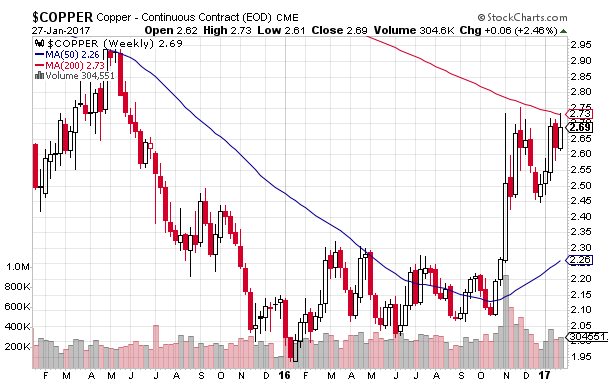

In commodities this week, the standout was copper. At the close of trading Friday, the copper price added $0.06 (+2.46%) to settle at $2.69 per pound. The weekly chart shows copper rejecting the 200-week moving average.

I don’t expect a meaningful break much higher from $2.70. A lot of copper’s post-election move has been, of course, due to president Trump’s infrastructure spending expected during his first term. I’m not sure if there is anything left in this play. I’ll have to see how copper trades when nearing the 200-week moving average at $2.73, this week.

I’m watching the USD Index for any breakdown below 99.00; the dollar-gold price break out above $1,220 per ounce; the CRB Index breaking above 200; and WTIC breaking above $55 per barrel. These are critical levels in each of these four markets.

In the Treasury market, the US Treasury 10-year yield move up one basis point—the second-straight week of higher yields—to close at 2.49%.

The spread between the US Treasury 10-year yield and equivalent German bund and Japanese 10-year note were little changed. This week, all was quiet on the interest rate front. Good, because the most likely market to derail the bull in stocks is the interest rate market.

And I suggest that, if your knowledge about what drives interest rates is lacking, well, ‘unlack’ it. You’ll find that the timing of your trades improves with one eye on the interest rate markets. Those watching junk bond yields prior to the Lehman Brothers collapse had a good heads up to what was likely next for stocks. In fact, the big winner of the crash of 2009 made a killing by shorting junk bonds when the spread between junk and triple-A narrowed to nearly nothing. How could you lose on a trade like that? Too bad high-yield ETFs (junk bonds) weren’t around to trade at that time.

And finally, I’ll comment about this week’s release of US GDP for Q4 of 1.9% (1.6% for 2016). Folks, 1.6% is essentially a flat GDP. After taking into account population growth, US per capita GDP went nowhere. And this poor performance is running concurrently with a Fed intent to raise rates three times this year?! Is this situation insane, or what?

Is the Fed expecting consumer price inflation to accelerate in 2017? I really think higher rates are planned to improve bank profits in 2017, and to make room for cuts during another crisis.

On a y-o-y basis, Material stocks returned 40.38%, the top sector performer. The next best performer was financial stocks with a 37.99% return, while the S&P 500 returned 21.87%.

Bottom line: If the Fed continues to raise rates, 2017 could be the year the market cracks. But, I doubt the Fed will raise rates three times this year. How many times has the Fed found an excuse not to raise rates during the seven-year near-zero rate policy, starting in December 2008?

And how will the Fed jibe with president Trump’s plans to lower (in the short term) the value of the US dollar in the Forex? Because of the unusually candid and combative posture of the Trump administration, many traders have been sitting out much of this market until more clarity of how this president is likely to proceed on many economic and geopolitical fronts.

Patience. Remember when I brought that word up, ‘patience’? Weeks before the election. And if you remember, too, my patience paid off with a $12,000 score on FNMA following the election results. Well, here we are again. So, let’s be cool.

“Be cool, honey bunny.” —Pulp Fiction (Miramax 1994)

Okay, let’s talk stocks. I want to provide updates to my Watch List and action from my positions.

This Week’s JBP Stock Ideas

TWITTER (TWTR)

Original report: 11/14/2016

On November 5, I alerted a Call position I took in TWTR at a strike price of $20.

To read my rationale for the Twitter Call, follow the link to my report: ‘Twitter Takeover Play’.

My bet with a Call option includes the possibility a suitor who can fix Twitter’s sluggish attempt to monetize the company may be announced by the expiration of my March 2017 Call.

At the close of Friday’s trade, the contract settled at $0.24. The option expires in 46 days.

I’ve been asked, from where do I expect a bidder for Twitter to come: Alibaba (BABA).

Update 01/16/2017:

There was absolutely no stock-specific news worthy of discussion this week. The stock traded within a 4.8% range during the week, and was rejected by the 52-week moving average at $17.47 on three separate trading days after managing to close above the average on Monday.

Update 01/23/2017

No news of import about TWTR this week. At the close of Friday’s trade, TWTR closed down $0.67 (-3.88%) to $16.58 per share.

Short sales now stand at 7.46% of TWTR float.

Of amusement, however, those faithful followers of former-President Barack Obama (@POTUS) suddenly found out the Twitter handle,“@POTUS,” is an official Twitter account of the President of the United States when tweets from the Trump administration began passing through Twitter’s feed system on the @POTUS account. Ooops.

Update: 01/30/2017

TWTR close down $0.01 for the week to settle at $16.57 per share, with no significant news other than the Jan. 23 announcement about Google’s purchase of Twitter’s development tools. No details about the sale were disclosed. The talk is, Twitter is streamlining its business as it continues its hopes for a suitor. If a suitor exists, no one appears to know or have seen anything. Hmm. There’s a lot of smoke in this trade, but no fire.

ABOUT TWITTER (TWTR)

Twitter, Inc. operates as a global platform for public self-expression and conversation in real time. The company offers various products and services, including Twitter that allows users to create, distribute, and discover content; and Periscope and Vine, a mobile application that enables user to broadcast and watch video live. It also provides promoted products and services, such as promoted tweets, promoted accounts, and promoted trends that enable its advertisers to promote their brands, products, and services; and subscription access to its data feed for data partners.

KANDI TECHNOLOGIES (KNDI)

Original report: 12/17/2016

As I alerted on December 14, I bought 7,000 shares of KNDI at $5.44 per share.

Here’s why I bought the stock:

I have traded KNDI earlier this year for a nice profit. Since then, the stock has come down significantly from the $6 and $8 range, dropping to as low as $3.40 in mid-November amid concerns of a hold to incentive payments due from the Chinese government.

So, what was the result of the hold on the company’s subsidy payment from the Chinese government?

On November 9, Kandi released a compete earnings report disaster. Revenue crashed to $6.4 million during Q3, down from $50.5 million, or -87%, from Q3 of last year. The company cited a freeze of incentive payments as the reason for the decline.

Kandi’s primary business is selling electric-vehicle parts to an electric-car joint venture, Kandi Electric Vehicles Group Co., with automaker Geely Automobile Holdings (NASDAQOTH:GELYF). The partnership is heavily dependent upon subsidies from the Chinese government, whose economic development plans include the development of electric vehicles.

However, because of nationwide investigates by Beijing into fraud allegations across the industry, incentive/subsidy payments throughout the industry have been frozen until the government completes its investigations. In the case of Kandi Electric Vehicles Group, without government funding, only 184 units of EV products were sold in Q3, a 96.9% decrease, y-o-y.

In response to the dramatic drop to revenue during Q3, Kandi Chairman and CEO, Mr. Hu Xiaoming, stated, “China’s central government preceded a review on the subsidies paid to all the EV manufacturers, which caused the 2015 subsidy payments remain unpaid industry-wide. The delay in subsidy payment heavily impacted the Joint Venture’s production and sales, which resulted in a significant decrease in our EV parts sales.”

Hu further stated that Kandi had been working with government officials and expressed confidence that the subsidies will be coming “soon.”

Earlier, in September, five of Kandi’s rivals were fined and removed from the list of companies eligible for subsidies.

On 29 November, KNDI announced that its wholly-owned subsidiary Kandi Electric Vehicles (Hainan) Co. Ltd received a subsidy payment of RMB 100 million (approximately US$14.5 million) to support its research and development expenditures for a new model of electric vehicle. This news of a subsidy payment to one of Kandi’s subsidiary suggests to me that the subsidy payment to the joint venture may in fact be sent “soon.” Why would Beijing clear a Kandi subsidiary but not the partnership?

News on progress of new factory in Hainan:

In the last earnings call, the company announced the following:

“Our Hainan facility construction proceeds smoothly and we have started to install the equipment as scheduled. We also made progress on the designed product in Hainan’s factory. We expect this product could be well received by the market. With respect to the production license for the new energy vehicle, we have accomplished last or fundamental work. We made our endeavors in the application and hope to opt in the license within 2017.”

This news release clearly indicates progress is being made according to the company’s production plans. I am expecting news from the company at some time between now and mid-2017 regarding the vehicles expected to be produced at the plant.

Insider buying:

On five separate days, from November 23 through to December 2, CEO/president Hu Xiaoming, 10% owner of Kandi Technologies Group Inc. (KNDI), purchased a total of 230,000 shares at a total transaction cost of more than $1 million. Hu’s purchase price range of $4.16 and $4.99 suggests to me the range of support for the stock will fall within this range and strongly suggests to me that Hu really does believe that the frozen subsidy payments due the company are, indeed, on the way.

The Play:

With 15.91% of the stock’s float held short, any positive news may drive the price rapidly higher, similar to the 11% price spike on November 29, the day of the news release regarding subsidy payments received related to the Hainan facility.

Now trading at the $5 level, I will be looking for the next move to the $5.50 level. The next resistance level may be at $6.00.

In the meantime, there’s a lot of time for news to be released about the company’s frozen subsidy payments before the company reports Q4 earnings is released, scheduled for early March.

My question is: if the CEO has bet $1 million on a favorable outcome to Q4 and/or imminent news regarding the company’s frozen subsidy payments, why wouldn’t you follow the CEO with your own stake?

Update 01/09/2017:

The latest inside purchase was on December 27, when CEO and President, Hu Xiaoming, bought another 57,060 shares at $5.15, for a total purchase price of $293,859. Xiaoming now holds 12,342,411, according to the SEC. That’s more good news.

Update: 01/16/2017:

There was a slight change to the stock’s short interest; it remains at a high rate of 15.92% of the stock’s float, slightly down from 16.02% of two weeks ago, but up from 15.2% at the close of trading on January 9. The short ratio has dropped slightly to 15.26 days, which is still a very high number of days to cover.

Update: 01/23/2017

No company-specific news was reported this week. KNDI closed the week down $0.20 at $4.85 per share. Short interest climbed back to 15.91% of float, while the number of days to cover rose slightly to 15.28 days.

Update: 01/30/2017

Kandi Technologies announced on Sunday (Jan. 22, just after the completion of my January 23 report) that the company’s Geely Global Hawk electric vehicle has been included in the Ministry of Industry and Information Technology of the People’s Republic of China’s Directory of Recommended Models for Energy Saving and New Energy Vehicle Demonstration and Promotion. The directory for 2017 was released on January 23, 2017.

Interestingly, the stock closed down on the day of the release, and continued to sell off on Tuesday and Wednesday to as low as $4.20 per share during Wednesday’s trade, following Monday’s close below the stock’s 50-day moving average.

But on Thursday, KNDI opened higher and spiked to as high as $4.72, a 12.4% move higher within 24 hours. I suspect $4.25 is the level at which buyers will be coming in strongly.

Also, I noticed that the lower KNDI dropped, the volume started spiking. As the stock rebounded back to $4.40+, volume was more than four-times normal. That’s a good sign of support at $4.25.

KNDI closed the week at $4.50, down $0.35.

ABOUT KANDI TECHNOLOGIES (KNDI)

Kandi Technologies Group, headquartered in Jinhua, Zhejiang Province, is engaged in the research and development, manufacturing and sales of various vehicle products. Kandi has established itself as one of China’s leading manufacturers of pure electric vehicle (“EV”) products (through its joint venture), EV parts and off-road vehicles.

LIQUIDMETAL (LQMT)

Initial report: December 14

On December 14, I bought 100,000 shares of LQMT at $0.196, and plan to increase my stake by an additional $30,000 in the future.

LQMT is a long-term trade, and has been a winner for me in the past. On November 1, I sold LQMT for a $4,300 profit from a two-month holding time period.

I now expect to be holding the newly-acquired shares for at least six months. My price target is $0.40, at minimum.

I attended the new CEO conference call on December 8 (after the close), and believe LQMT is a sleeping giant, with the potential to be profitable and to be listed on the AMEX in the coming years.

WHY I’M LONG LQMT

Background:

On March 10, Liquidmetal and DongGuan Eontec Co., Ltd. entered into an agreement, whereby Professor Yeung Tak Lugee Li, Chairman of DongGuan, agreed to purchase up to 405 million shares of LQMT stock for a purchase price of $63.4 million.

A term of the deal included the purchase of 105 million shares at $0.08 per share for a purchase price of $8.4 million, which did indeed happen on March 10. An additional term of the deal included the purchase of an additional 200 million shares at $0.15 per share for a purchase price of $30 million, and the purchase of 100 million shares at $0.25 per share for a purchase price of $25 million. In total, Mr. Li is eligible (board approved the agreement in May) to purchase 300 million shares for a purchase price of $55 million.

In addition, Liquidmetal issued a warrant for an additional 10,066,809 shares at an exercise price of $0.07 per share.

So, who is Professor Yeung Tak Lugee Li? He is the Chairman of DongGuan Eontec Co., Ltd., in China. The company symbol on the Shanghai Exchange is (SHE:300328.SZ), where the shares currently trade at (yuan)14.02, or $2.10 per share. The market capitalization of DongGuan Eontec is approximately $850 million, and is a highly profitable company, with net profit margins exceeding 10%. The company manufactures next-generation metals for other commercial enterprises involved with the production of consumer products, just as Liquidmetals is in the business of producing.

In 2012, Li founded Leader Biomedical.

In 2013, he acquired a majority stake in publicly-traded aap Joints, a division of aap Implantate AG in Berlin, Germany.

In 2014, Li acquired EMCM, a biomaterials contract manufacturer, from aap Implantate.

All of these companies that Li purchased are in the business of developing and manufacturing next-generation metals for commercial products. Therefore, my stake in LQMT is motivated by the modus operandi of Mr. Li taking control of LQMT with plans to move LQMT onto the AMEX.

On December 14, the company announced that it has named Professor Lugee Li as President and Chief Executive Officer of Liquidmetal Technologies.

“Professor Li has served as a member of the Company’s Board of Directors since March 10, 2016 and is the sole owner of Liquidmetal Technology Limited, a Hong Kong company that is the Company’s largest shareholder,” according to the news release. “Professor Li will not be taking any compensation as a result of his appointment as President and Chief Executive Officer.”

Now that Li has taken control of Liquidmetals, I expect rapid progress. This trade idea is very similar to FNMA, in that the stock is at an inflection point. Right now nobody is paying attention to the stock, just as no one was paying attention to FNMA when I bought 40,000 shares of the stock at $1.72.

With Li on board, I’m going to be patient with LQMT, as I expect the stock to start and stop until more news from the company begets more investors and liquidity moves to higher prices during the coming year.

Update 01/09/2017:

The company issued a news release, stating “it has ordered its first amorphous metal molding machine from its Licensee, Eontec Co., Ltd. The machine design is based on a die casting platform and is complementary to the injection molding machine developed with Engel. Delivery of the machine is expected in March 2017.”

A company doesn’t order production equipment unless a market has been targeted, or has been penetrated through contingency agreements. Not unlike other micro-cap companies, Liquidmetals’ plans are opaque to investors, which is a good thing for those seeking to get into a stock at very low prices. The bad, of course, is the lack of information in order to make a judgment regarding the stock. But in my case, I attended the conference call held by the company’s new CEO in early December, so I’m as close to an insider without actually being one. Hang in with me on this stock; it’s doing fine.

Update: 01/16/2017

There was no news to report this week, but the stock traded up $0.0133 to close at $0.2281, a 6.2% gain. So, I’m well into the ‘green’ with a 16.3% profit on this stock, after only 30 days of holding it.

Update: 01/23/2017

There was no company-specific news this week. LQMT traded virtually unchanged to settle at $0.2280 on Friday.

Update: 01/30/2017

LQMT rose $0.005 to close the week at $0.2330 per share.

The news this week took place on Wednesday (Jan. 26), when the company announced it had entered into agreement to purchase approximately 41,000 square feet of industrial space in Lake Forest, California for approximately $7.8 million. The company expects to finalize the purchase on February 17, 2017.

So, Liquidmetals is moving along, and probably will be making more announcements in the future regarding the company’s new facility.

More than 10 million shares traded this week, nearly triple last week’s volume.

It pays to participate in conference calls, because I think I nailed this stock. I believe the really big moves may be coming later.

The next level of resistance for LQMT is $0.25. If/when $0.25 is breached, $0.30 is the next price of significant resistance. The shorts have reached 15.91% of the stock’s float, which calculates to more than 14 days to cover. Hold onto your hats!

ABOUT LIQUIDMETALS (LQMT)

Liquidmetal® Technologies researches, developments and commercializes amorphous metals. The company’s revolutionary class of patented alloys and processes form the basis of high performance materials in a broad range of medical, military, consumer, industrial, and sporting goods products. Discovered by researchers at the California Institute of Technology, Liquidmetal alloys’ unique atomic structure enables applications to achieve performance and accuracy levels that have not been possible before. As the company controls the intellectual property rights with more than 70 U.S. patents, these high performance materials are dramatically changing the way companies develop new products.

Source: Liquidmetals Technologies

FANNIE MAE (FNMA)

Initial Report: 01/09/2017

As loyal subscribers know, I made a killing on FNMA after selling out for a $12,800 profit on November 23 on a bet that a Trump victory at the polls would soar the stock. As a reminder to my long-term subscribers, read my article of a year ago, If Trump Wins The White House, FNMA Soars. In the article, I suggest that Trump, the businessman, fully understands the wrong perpetrated by the US government against stockholders of Fannie Mae. That’s not too hard to conclude, and is why the stock soared following his win at the polls.

From the article, follow the links, because if you do and read the supporting documentation of my article, you’ll come away with a firm grasp of the political and legal issues involved with FNMA and the stakes involved to traders of the stock.

Trump takes the oath of office on the 20th, so now what? As I see it, the issue of Fannie Mae’s future now becomes more of a political than a legal one.

Changing the structure of Fannie Mae may turn into a tough fight for Trump on Capitol Hill. The idea of a nearly eight-decade-long legacy government GSE being throw to the wolves (as Democrats might see it) will drain a lot of political capital that each president starts with when initially entering the Oval Office. FNMA is no Social Security issue, but it is huge, especially, with Democrats, and ranks as a high-profile political fight I expect between Trump and Democrats, for sure.

On the Republican side, throwing Fannie Mae to the wolves, if you will, represents the other side of a clear victory for one party over the other. A Republican dream is to allow the private sector to bid for tranches of Fannie Mae’s $5 trillion mortgage holdings. That’s huge business!

What would a privatization that do for mortgage interest rates?

Rates would soar, of course. In droves, potential homeowners would be shut out of the mortgage market, and the US economy would take a whopping hit. Oh, and the 30-year mortgage? Forget about it. The advent of the 30-year mortgage was facilitated by the mere existence of the GSE in the first place. Instead, a 15-year loan would probably become the longest fixed-term loan a borrower could achieve.

Now, picture a prospective homeowner, whose principal and interest payment each month would result to as much as 71% leap under a fully-privatized plan? At a 15-year mortgage term and a, say, 5.5% interest rate on a $170,000 loan, his payment would jump to $1,389 per month, from $811.

So, forget about that! A cold-turkey, fully-privatized plan won’t happen. Even the staunchest anti-Fannies would not vote for such a draconian plan. Under a scenario, even remotely close to this one, would quickly become Trump’s ‘Obama Care’.

So what is more likely to result as a compromise?

The most likely scenario is one that compromises between upholding stockholders’ rights and a fix to the impediments that already work. That’s where the expertise of Trump’s nominee for Secretary of Treasury, Steven Mnuchin, a Goldman Sachs alumnus, comes in, who stated on November 30 that he would like to see Fannie Mae privatized “reasonably fast.”

“We will make sure that when they are restructured, they are absolutely safe and don’t get taken over again,” he told Fox News. “But we’ve got to get them out of government control.”

Ah, so what do I read into Mnuchin’s comments? I think a recapitalization plan may be the settlement Trump and the Republicans hope to achieve, as a first step. That would delight the Democrats, but tick-off Republicans. So, what to do?

To get Republicans aboard a recapitalization plan, Mnuchin and Company may propose a “slow motion” to privatization plan, as I suggested, a plan of which may involve a decade-long unraveling of the implied government backing of mortgages.

A wrinkle to the slow-motion compromise may also involve a slow-motion recapitalization scheme for Fannie Mae, which may actually be the mechanism that facilitates an orderly unwinding of government control, similar to the present FDIC scheme of backstopping the banking system.

I’m aware that reserves at the FDIC are a joke, but this framework may be in Mnuchin’s head as part of a compromise between political parties and between plaintiffs and the FHFA in the ongoing lawsuits. Essentially, a deal may come down to a matter of initially and adequately funding an FDIC-like scheme to backstop the mortgage market, while at the same time let the taxpayer off the hook of Fannie’s balance sheet—in theory, of course. But that may be the pitch Mnuchin can make to both Republicans and Democrats, and may serve, too, as a great talking point for Republicans to make to their constituencies.

As investors of FNMA, there are many more scenarios that involved FNMA stockholders getting paid through a windfall deal (fast or slow) than scenarios that shaft stockholders.

Unlike the financial media hyping the Fannie Mae issue as the next Ali-Frazier fight (Am I showing my age?), as I see the political path to a profit buried in the FNMA trade, a Trump deal to unlock Fannie Mae’s balance sheet to settle lawsuits is doable. In that case, $4 for FNMA represents a potentially huge discount to its underlying value.

I’ll let you know what I decide to do about FNMA.

Update: 01/16/2017

No news about FNMA. And if you look at the chart, FNMA’s range this week was the narrowest since mid-October. Boring.

Update: 01/23/2017

FNMA traded in a range of $3.68 and $3.89 this week, and settled at $3.79, down a penny at the close of trading on Friday. Now that Donald Trump is officially the President of the United States, all shareholders await further word from the Trump administration regarding Washington’s role concerning Fannie Mae.

Update: 01/30/2017

FNMA was up strong this week with a $0.38 gain to settle at $4.17 per share. Apparently, Pershing Square Capital’s Bill Ackman released an update to investors, in which he stated, “Despite significant share price appreciation in 2016, we believe the shares of a reformed Fannie and Freddie will be worth a multiple of their current price.”

I want to remind my subscribers that Pershing own $9 billion of FNMA; he’s almost betting the house on the outcome of the final disposition of Fannie Mae and Freddie Mac. Ackman’s restatement of his optimistic thoughts on FNMA drove this stock this week.

ABOUT FANNIE MAE (FNMA)

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation’s purpose is to expand the secondary mortgage market by securitizing mortgages in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations (or “thrifts”). Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac.

CROCS (CROX)

Initial Report: 01/16/2017

As I alerted on January 12, I bought 3,000 shares of CROX at $7.07. My initial goal is to sell at around $8.50, which is a significant resistance level. I expecting to hold CROX for as short as a few weeks to as long as a few months.

Crocs is a play on a successful turnaround. After Q2 and Q3 showed a decline in revenue and gross margin, I’m anticipating Q4 to satisfy investors. The Q4 earnings report is expect on March 6, and the consensus forecast is for Crocs to earn $0.15 per share. If the company can reach the consensus of $0.15, an $8.50 price target price I’ve set for the stock may easily be reached.

After Blackstone Group came to the aid of Crocs to bring in experienced executives and, specifically, execs who specialize in turnarounds, I see absolutely no reason for this company to not ‘right’ itself. People love this brand much more than they hate it. That’s a good enough brand sentiment to raise the company’s Price/Sales back up to 1:1 from today’s 0.49:1. To me, the share price of CROX is much too low when taken within the context of an industry average Price/Sales of 1.67!

Remember, too, CROX used to be a $70 share price, 10 years ago. If progress is made at the company, more traders will no doubt see the potential I see in the company.

George Putnam of The Turnaround Letter likes CROX, too, stating in his analysis of CROX, “They [Crocs] are starting to get traction” from the new management team. Who’s George Putman? Since 1986, Putnam’s picks have averaged 11.4% gains per year! So, I’m in pretty good company on this pick.

Oh, and one last point. Ten institutional investors jumped on the stock during Q3, a quarter when the stock was trading at between $8 and $12 per share. Well, yours truly is in CROX at $7.07.

Update: 01/23/2017

CROX traded strongly higher this week by $0.18 to close at $7.16 per share on very low volume. CROX ‘did me good’ this week, for sure.

The 52-week moving average calculates to $8.97 per share, and is descending. So, there’s still much room for the stock to move higher before encountering technical resistance.

The next ‘magnet’ price for CROX is $8.00. Shares held short reached 7.34% of float and 5.79 days to cover.

Update: 01/30/2017

CROX closed at $7.22 per share, up $0.01 for the week, on relatively light volume. There was no news from the company, but there was a slightly interesting issue regarding the potential impact on Croc’s earnings, if President Trump manages to slap a 20% import tax on goods made in Mexico.

According to analysts, approximately 5% of Croc’s manufacturing is performed in Mexico. The impact to earning is estimated at $0.05 per share. Eh. A successful turnaround eclipses this news by a country mile, but nevertheless the point about the potential impact on Croc’s earnings due to its Mexican manufacturing operations is of interest anyway.

There was no change in the short position in CROX.

ABOUT CROCS, INC. (CROX)

Crocs, Inc., together with its subsidiaries, designs, develops, manufactures, markets, and distributes casual lifestyle footwear and accessories for men, women, and children worldwide. It offers various footwear products, including clogs, sandals, wedges, flats, sneakers, and boots. The company’s primary trademarks include the Crocs logo and the Crocs word mark. It sells its products in approximately 65 countries through domestic and international retailers and distributors, as well as directly to end-user consumers through company-operated retail stores, outlets, Webstores, and kiosks. As of December 31, 2015, Crocs, Inc. operated 275 retail stores; 98 kiosks and store-in-stores; 186 outlet stores; and 12 company-operated e-commerce Web stores. The company was founded in 1999 and is headquartered in Niwot, Colorado.

Source: Finviz.com

GROUPON, INC. (GRPN)

Initial Report: 01/16/2017

On Friday I alerted a purchase I made of 10,000 shares of GRPN at $3.54 per share. I really suspect that GRPN is running on, both a rumor circulating that Alibaba (BABA) is sniffing around the company with the idea of buy it, and the January Effect.

Who knows, maybe Alibaba will be the focus of a bunch of rumored takeovers this year. Alibaba was rumored to buy Twitter (TWTR), too. Remember?

But Alibaba’s 5.6% stake in GRPN is not a rumor, so Alibaba may in fact be shopping.

So far, GRPN’s 7.8% move higher this year is impressive, and probably has something to do with tax sellers in December picking the stock back up for a speculative play in 2017. But GRPN did get a nice shot in the arm to as high as $3.80 on the Alibaba rumor; so, I’m holding onto this potentially hot stock.

Okay, here’s the ‘skinny’ on GRPN. I believe that the rumor of Alibaba buying Groupon isn’t far-fetched at all. A takeover actually makes sense for Alibaba in a strategical sense, in that it’s well-known that Alibaba seeks to expand globally. And why not enter the largest economy of the world? The US.

Groupon’s US Q3 billings rose strongly by 6%, y-o-y, while the rest of the company’s business overseas stank to high heavens, which isn’t necessarily a bad thing for Alibaba. Alibaba may only be interested in the US market, anyway.

Look at it this way: Alibaba is looking at Groupon’s Price/Book of 0.66. And it appears that Groupon is truly turning around. The company’s earnings have been better than expected since Q3 of 2015, and in Q3 of 2016, 1.2 million net new customers were added to the company’s customer base. With approximately 30 million customers on Groupon’s books, Alibaba may be mighty tempted to buy this customer book on the cheap.

And finally, on a somewhat humorous note, Chairman of Alibaba, Jack Ma, met with president-elect Donald Trump on Tuesday. I can just imagine how that meeting went, as I can envision Ma asking permission of Trump to come into the US and buy an American company. As long as no one heard Trump bellow, “Okay, get ’em outta here,” I think we’ll be hearing more from Ma in 2017.

Update: 01/23/2017

At the close on Friday, GRPN settled at $3.45 per share, down $0.13 for the week. There was no company-specific news this week. However, there’s an interesting article published on January 16 about Groupon, entitled, ‘Assessing Groupon’s Value to Alibaba’. It’s a good read.

In addition, the management buyback program established at Groupon may help buoy the share price from current levels. And take note of GRPN’s large short position of 10.87% of the company’s float.

Update 01/30/2017

GRPN traded flat this week to close at $3.45 per share on relatively light volume. The large short position of 10.87% of float was unchanged this week.

On Monday, Groupon settled legal action taken against the company regarding financial derivative issues. According to the company, the financial impact from this settlement will be negligible to earnings.

The company also announced its Q4 and full fiscal 2016 earnings report card will be released on Wednesday, February 15. I’ll be anxious to see how many more new customers the company added, and whether another surprise earning release is in store for me. Q3 2015 and Q3 2016 surprises to the upside in earnings and stock price may be a nice bonus to my bet of progress made in the company’s turnaround efforts.

ABOUT GROUPON, INC. (GRPN)

Groupon, Inc. operates online local commerce marketplaces that connect merchants to consumers by offering goods and services at a discount in North America, Europe, the Middle East, Africa, and internationally. It also provides deals on products for which it acts as the merchant of record. The company offers deals in various categories, including food and drink, events and activities, beauty and spa, health and fitness, home and garden, and automotive; and deals on various product lines, such as electronics, sporting goods, jewelry, toys, household items, and apparel, as well as provides discounted and market rates for hotel, airfare, and package deals. It offers its deal offerings to customers through Websites; search engines; and mobile applications and mobile browsers, which enable consumers to browse, purchase, manage, and redeem deals on their mobile devices, as well as sends emails to its subscribers with deal offerings that are targeted by location and personal preferences. The company was formerly known as ThePoint.com, Inc. and changed its name to Groupon, Inc. in October 2008. The company was founded in 2008 and is headquartered in Chicago, Illinois. Groupon, Inc. is a subsidiary of The Point, LLC.

LendingClub (LC)

The company has been in a turnaround phase following revelations in May 2016 that Lending Club CEO, Renaud Leplanche, had sold $22 million of loans to a investment bank, Jefferies, that did not match the client’s requirements, i.e., fraud. On May 16, the U.S. Department of Justice served a subpoena for records involving the company’s deal with Jefferies.

As a result, LC had lost nearly 57% of market capitalization from the scandal, but has since recovered much of the initial drop, rallying 67% from the May 17 low of $3.44.

But this ‘turnaround’ stock may be just beginning.

The company has regained confidence among its credit suppliers in the banking industry as a result of LendingClub improved internal controls, a new CEO, and continued leadership in this new industry segment.

But, of course, competitive forces have entered the mix for LendingClub. As peer-to-peer gains traction in the Internet lending space, many of the company’s competitors will most likely drop off from the race in this new and exciting form of lending. LendingClub, however, shines in this environment, as the company’s brand seeks to consolidate business left behind by fallen competitors.

THE TRADE

The trade focuses upon, specifically, the upcoming company’s Q4 earnings report, scheduled for February 14. If past price action of stock may be used as my guide, I expect a pop in the stock leading up to earnings, and possibly more pops after the release on February 14. Here’s how LC moved following the last two earnings reports.

On August 8, 2016, LendingClub beat Wall Street estimates for Q2 2016 with a $0.05 per share net profit. Estimates ranged from a profit of $0.04 per share to a loss of $0.11. Traders reacted by taking LC to as high as $5.91 within five trading days from the low of $4.30 at the release, a 37.4% potential gain from a long position just prior to the report.

On November 8, 2016, Wall Street estimated LendingClub’s Q3 earnings per share would fall within a range of a loss of $0.04 per share and a loss of $0.08. LendingClub reported a loss of $0.09 per share.

However, better news was issued with the report, that included National Bank of Canada opening credit lines with LeadingClub worth $1.3 billion. As a result, the stock soared, moving up as high as $6.56 from the low of $5.30 prior to the earning report for a potential return of as high as 23.7% within five trading days.

I expect similar reactions by traders as we approach February 14. And now that LC has convincingly broken through its 50-day moving average (MA) to the bull side—and has had its 50-day MA this week make a bullish cross with the 200-day MA—the momentum in the stock has been to move higher, with the path of least resistance pointing to a possible test of the $6.58 high of September 19.

Update: 01/30/2017

LC kicked higher by $0.39 (+6.78%) to close at $6.14 per share. It appears the move in LC coincided by a big move in bank stocks this week. The KBW Bank Index (BKX) rose sharply by 2.61% this week, taking LC with it, especially on Monday, when both securities rose sharply.

Other than that activity, no company-specific news was released about LendingClub.

I should also note LC’s large short position of 13.8% of the stock’s float. Earning are due next month, and what a nice short squeeze could come out of a good earnings report.

ABOUT LENDINGCLUB (LC)

LendingClub Corporation, together with its subsidiaries, operates as an online marketplace that connects borrowers and investors in the United States. Its marketplace facilitates various types of loan products for consumers and small businesses, including unsecured personal loans, super prime consumer loans, unsecured education and patient finance loans, and unsecured small business loans. The company also offers investors an opportunity to invest in a range of loans based on term and credit characteristics. It serves investors, such as retail investors, high-net-worth individuals and family offices, banks and finance companies, insurance companies, hedge funds, foundations, pension plans, and university endowments. LendingClub Corporation was founded in 2006 and is headquartered in San Francisco, California.

Until next time…

Trade Wise and Green!

Jason Bond

0 Comments