There’s a lot of uncertainty in the market…

And when there’s uncertainty, volatility picks up. While most traders will sit and stare at this price action and get shook, I look to exploit the inefficiencies.

Not only are there market-wide catalysts on the table, but it’s also earnings season — and that should juice the volatility premiums even more.

Listen, I’m all about teaching you different ways to attack the market — and today, I want to show you how to trade post-earnings and take advantage of the uptick in volatility.

I’ve got my eye set on a few names this week, and I want to show you what I’m watching in them.

Don’t Think Of Volatility As Your Enemy, Think Of It As Potential Opportunity

If you don’t already know, volatility is thought to be mean-reverting. In other words, when volatility spikes to extreme levels, there’s a good chance it’ll pull back.

When it’s earnings season, I believe it’s the perfect opportunity to take advantage of a potential pullback in volatility. You see, it’s an observation that most elite options traders know about.

Ahead of earnings, there’s a lot of uncertainty — so it makes sense the options trade at a premium, in terms of volatility. What happens after an earnings announcement? There’s less uncertainty and the news is out.

What do you think happens to the volatility in the options?

They get sucked out, and that’s what I want to take advantage of.

So how does this all work?

Well, first and foremost, I want to hedge my position, while still having the ability to generate fast returns. So I want to look at bull puts after the news is out.

For example, Apple Inc. (AAPL) is set to report earnings on Thursday.

Since earnings can be pretty wacky, I’m going to wait until after the dust settles and look to either buy the dip or play the gap and go.

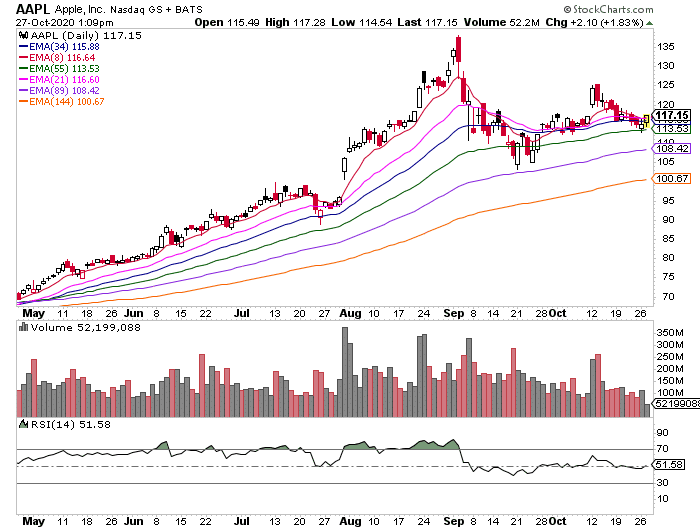

It’s helpful to keep an eye on key levels. For me, I’ll look at the 89- and 144-day exponential moving averages (EMAs), which is around $108 and $100, respectively. I figure those will be good areas of support.

If AAPL takes off, the 34- and 55-day EMAs look attractive as well for potential support levels. Those are $116 and $113, respectively.

So why is that so important?

Well, it helps with my strike price selection for when I sell a put spread. In other words, I may look to sell say the $100 puts and purchase the $95 puts to play for a bounce (if AAPL sells off). Not only will I be able to take advantage of the volatility, but I don’t necessarily need the stock to move to my favor.

It’s similar to if AAPL breaks out.

If the price action signals AAPL will run higher, then I can look around the shorter-term EMAs to select my strike price.

Of course, we’ll know how things will shake out on Friday morning(the day after the earnings announcement).

There are plenty of major companies reporting earnings, and I believe my strategy will come in handy. For now, I’ll remain patient and wait until after the earnings announcement because it’s safer in my opinion.

In this market environment, it helps to think of different ways to attack the market… and I believe bull puts can be advantageous right now.

In my next letter, I’ll show you different earnings plays on my radar and how to potentially take advantage of them.

I’m at a low right now just a few hundred dollars. Actually Jeff Williams one of your members convinced me to pay the $2.79.