It’s been a wild market the past few sessions… and I think it’s important as a trader to be able to adapt when volatility picks up.

Today, I want to walk you through how I plan to attack the market and what I’m seeing at these levels.

For me personally, I’m going to remain careful and only trade stocks or options in which I see a definable edge.

You see, stocks take a turn in one direction, there are some strategies I’ll look to implement and other factors I want to take into account before I get into any position.

Right now, I’ve got my eye on a few key indicators and potential trades I may put on.

Why I’m Going To Remain Nimble At These Levels

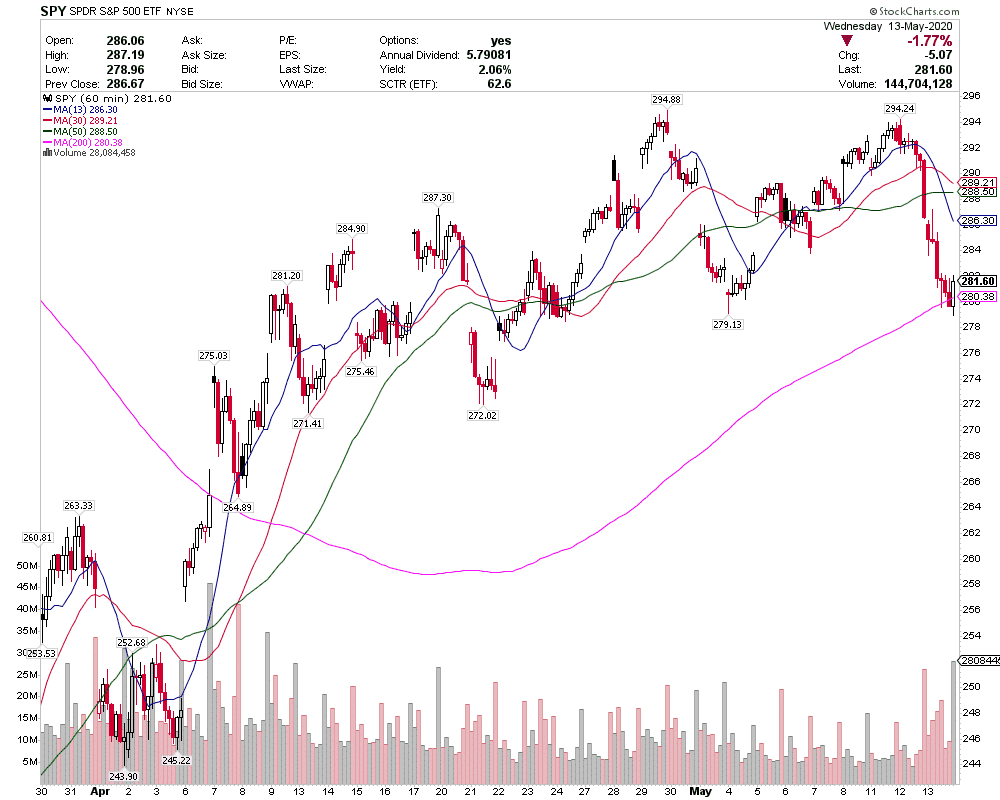

With the market acting the way it has been, I’m following major indices closely. You see, I believe by following DIA, SPY and IWM — major market tracking exchange-traded funds (ETFs) — I’m able to uncover potential opportunities.

Here’s what I sent out to Jason Bond Picks subscribers in the pre-market this morning…

A quick overview of the DIA, SPY and IWM shows the markets having bounced into EMA 89 resistance and rolling over, which could mean they’ll revisit the lows from back in March. Something to definitely pay attention to. For now, I intend to take shots buying the dip but keep good watch on the macro view with quicker moves to cash if necessary.

You see, right now, while some traders are looking to play defense… I’m still looking to get offensive. For example, this week, I scored about $25K betting against indices with puts… and locked those in due to the support at the 200-day simple moving average (SMA).

Chart Courtesy of StockCharts

Now, I may look to bet against the market if the SPY rolls over… but I’m going to remain nimble and not take massive bets or get too heavy on one side.

I think if stocks do roll over, there may be a quick momentum swing trade there for me to take advantage of.

With small- and mid-cap momentum stocks, I’m only noticing a few opportunities that stick out to me.

One Momentum Stock On My Radar

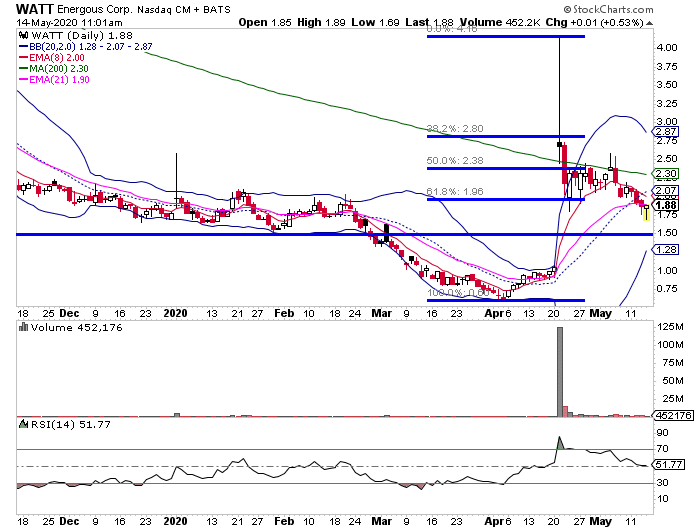

For example, Energous Corp. (WATT) is on my radar right now.

Chart Courtesy of StockCharts

Although the stock broke key Fibonacci support levels, I’ve noticed it’s common for WATT. Right now the stock is drifting into that recent gap up. For me personally, I may look for an entry between $1.50 – $1.70.

However, I want to see the stock remain above $1.50.

Right now, I believe there’s a looming catalyst in WATT off the back of the recent FCC news.

I’ll be sure to let my subscribers know about my moves if I do decide to take them in WATT.

0 Comments