While some talking heads and major hedge funds have noted the market can head lower at these levels, it certainly doesn’t feel that way. Stocks jumped yesterday and the Dow is back to where it was in March, after the positive news about a potential coronavirus treatment.

Of course, after that surprise news Thursday night, stocks were rockin’ on Friday. The big question right now: Does the market continue higher from here, or will corporate earnings shock the market?

To be honest, who knows… and that’s really a coin toss to me, so I don’t really want to play the overall market. Instead, I’m sticking to my guns and focusing on momentum stocks.

Why?

Well, I believe I have an edge in the market with my scalable patterns, and I’ve been able to locate some stocks that have run higher BEFORE the move happened — like Arcus Biosciences Inc (RCUS).

Now, I want to walk you through how I spotted a quick winner in RCUS and what I could do differently if I see a similar setup next time.

Teachable Moment: How I Spotted The Trade In RCUS

If you don’t already know, during the pre-market, I’m on the hunt for momentum stocks to trade. Of course, with so many stocks out there, it often gets difficult to figure out what stocks to potentially buy.

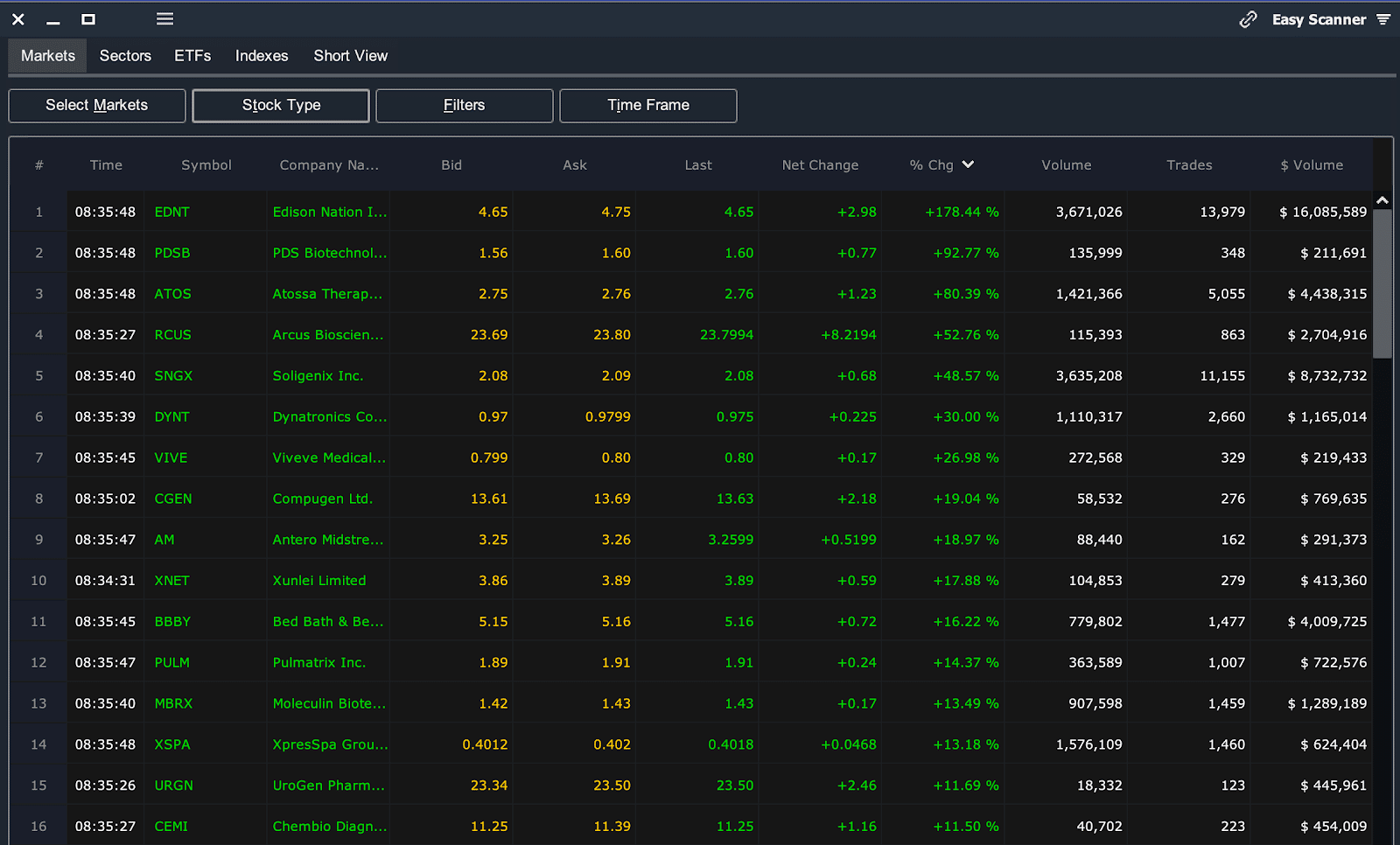

However, I’ve figured out a way to filter down for stocks set to potentially run. Basically, in the pre-market, I look for stocks with at least $200,000 in dollar volume before the opening bell.

Source: © Scanz Technologies Inc.

Once I’ve filtered for stocks with at least $200K in pre-market liquidity, I just sort by % change on the day. If you look at the screenshot above, you’ll notice RCUS was fourth on the list. When I look for potential trades, I keep them on my radar after the opening bell and wait for my setup.

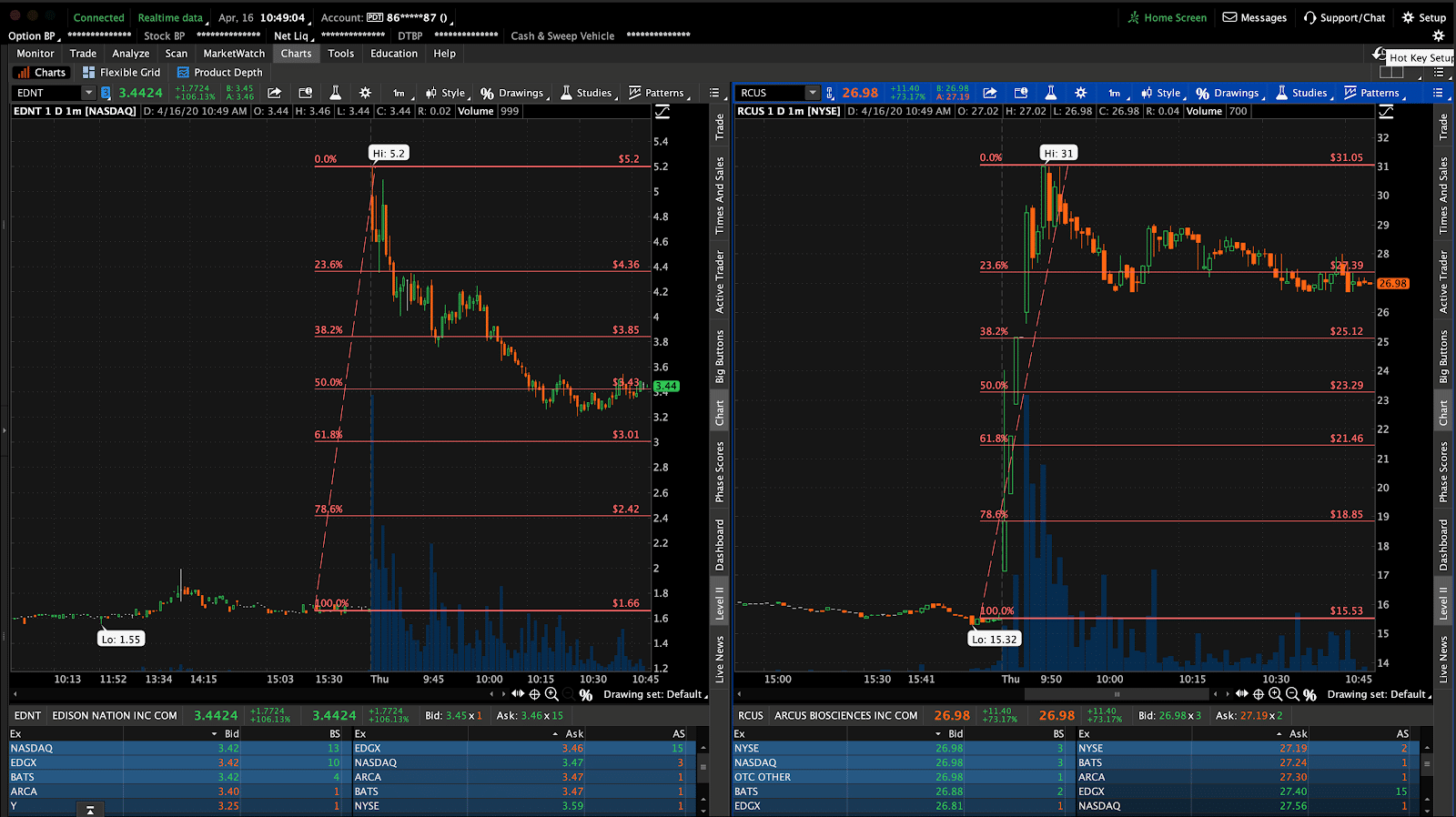

Now, if you look at the chart on the right-hand side, RCUS was forming one of my favorite setups: the bull flag.

Here’s what I sent out to my subscribers on Thursday at 10:52 AM ET, in an advance notice alert.

News winner, bull flag in play above $27 – $25, goal is $31 or breakout above hod. Probable day trade, possible play. Thinking 500 shares above $27, stop below $23 aggressive or $25 conservative.

Also watching EDNT above $3.40.

I also had EDNT on my radar, but didn’t take the trade (it’s the chart you see on the left-hand side above).

My Action

After I saw my pattern and an area of value, I entered the trade. I bought 500 shares of RCUS at $28, and my initial goal was $31 or higher. My stop loss was around the $23-$25 (right between key Fibonacci retracement levels).

At 1:44 PM ET, I actually took profits off the table and locked in a $600 winner. Not an amazing trade, but that was good for a $500 winner.

The reason I took profits?

Here’s what I sent to my subscribers in my sell alert.

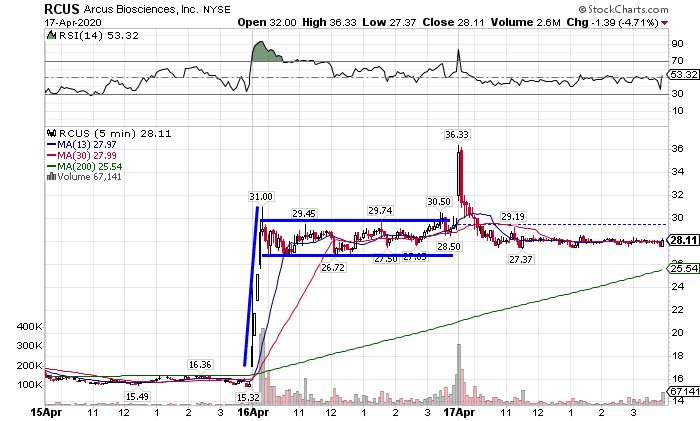

This one is wiggling around inside the flag and while it’s still looking strong, the overall market into the close concerns me so I’m going to go ahead and put 6 $100 bills in my pocket or about 5%. Very predictable pattern, didn’t quite get the $31 breakout but since I took the trade markets have weakened and I feel like this is a nice win for me, despite not being huge. Ideal entry was $27.30 so had I gotten that it’d be $.70 more / share but it moved on me after advance notice, which happens with momentum stocks. Out at $29.20 into the $30 test.

Base hits add up.

Of course, the day after I got out… RCUS hit a high of $36!

I’m not too mad at myself for missing that move because the overnight news was a complete surprise, and at the time… I thought taking profits was a good idea.

However, if I see a similar setup next time, I believe it could be beneficial to take a portion of my position off the table and let the rest ride while practicing proper risk management. In this market environment, I’m still uncovering potential momentum trading opportunities… and until that changes, I’m sticking to my strategy.

0 Comments