Earlier this week, I mentioned one momentum stock to keep on the radar…

And it made the move right where I expected it to.

What stock am I referring to?

Gogo Inc. (GOGO).

On Sunday, I mentioned how there could be a positive catalyst and there was a bullish chart pattern…

Today I want to provide you with an update on GOGO and what I’m watching for in it.

You see, there are key levels and another pattern developing right now, and I think it’s one stock to keep on the watch-list.

GOGO Trade Idea Recap

GOGO is the leading provider of broadband connectivity for airlines and it recently announced a positive catalyst when it came up on my radar.

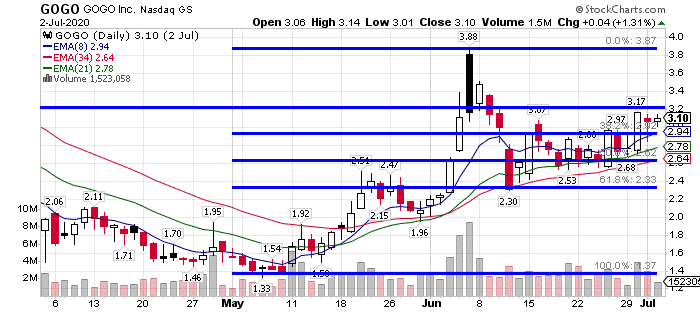

Here’s a look at what the stock is going on the daily chart when I mentioned it the other day.

Source: StockCharts

The stock held key Fibonacci retracement levels, and it was prime to retest highs, in my opinion.

You see, when I notice this pattern and the stock holds the key support level, it typically retests the recent high. Here, it was $3.88.

With GOGO, there was a potential short squeeze in the works.

GOGO only has 52.07M shares floating. Of those 52.07M shares floating, 45.73% are short.

When there’s such a high short interest, coupled with a low float… there’s not a whole lot of supply.

If there’s an actual positive catalyst and the stock runs higher, momentum buyers step in and the shorts may look to cover.In turn that creates a scenario in which the stock can explode.

Well, on Tuesday, GOGO announced it was providing inflight connectivity beginning at 3,000 feet. The stock didn’t move a whole lot off of that though.

However, there is another looming catalyst: the re-opening of states and more flights.

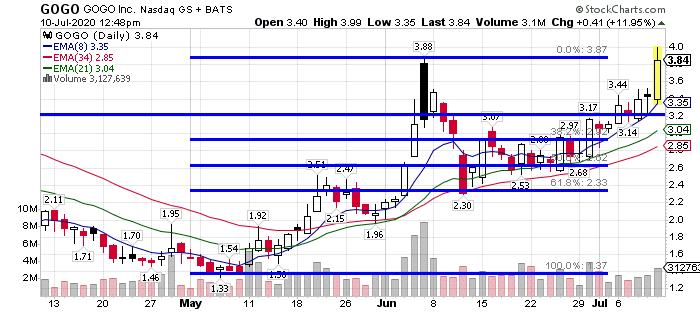

With positive developments in coronavirus treatment news on Friday… airlines gained, and consequently, GOGO caught a pop too…

Source: StockCharts

At the time, I was looking for a move to the $4 area in GOGO… and I was pretty darn close, because it hit a high of $3.99 in the morning session.

What’s Next For GOGO?

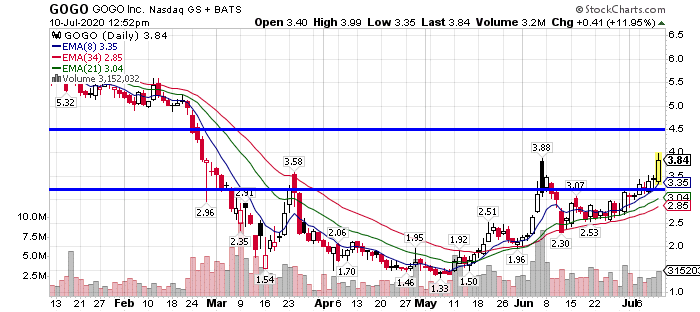

If flights do start to pick up significantly, I think GOGO can run higher and potentially return to February levels

Source: StockCharts

Right now, the key level to keep an eye on is around $4. If it gets above that, I think GOGO can make a move to $4.5, and thereafter, $5 isn’t out of the question.

With such high short interest, I wouldn’t be surprised if a move to those levels happen quick.

This is one stock I believe traders should have on there radars.

Now, if you want to learn how I’m able to identify these trading opportunities using, what I believe to be, simple patterns… then you’ll want to check out my latest eBook.

Inside, you’ll find case studies, and my techniques to hunt down momentum stocks… BEFORE they run.

Great info, love to learn how traders think and what to look for.