Stocks are taking a hit this week… and by the looks of it…

Next week is going to be interesting with a holiday-shortened week.

When the market is as wacky as it is right now, I’m not going out on a limb to play momentum in either direction.

That doesn’t mean I’m not actively hunting down momentum stocks…

I’m just more cautious about where I put my money.

You see, in times like these…

I want to try to stack the odds in my favor.

How do I attempt to do that?

By using a strategy with the “bookie” advantage.

I know what you’re thinking…

What’s the strategy and how can I learn more about it?

An Alternative To Trading Stocks

Let’s face it, when volatility picks up…

Things can get scary holding stocks overnight.

I get that not everyone has the stomach to handle that risk…

That’ why I actually use a risk-defined strategy that actually allows me to express my bullish or bearish opinion on a stock.

If you’re confused at first…

Don’t be.

Let me show you how I actually try to stack the odds to my favor.

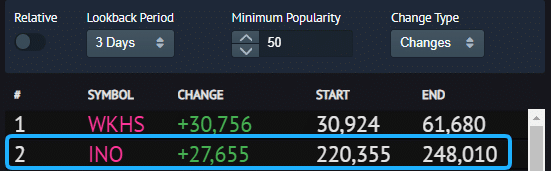

Inovio Pharmaceuticals (INO) has been one of the hottest stocks on Wall Street…

It’s one of those momentum stocks that everyone and their brother want in on.

I mean, it’s been one of the hottest stocks to buy among Robinhood traders over the last 3 days…

With more than 27K accounts adding the stock to their portfolio…

Some traders are buying shares to express their bullish opinion.

But with the stock trading around $30, some are looking to the options market.

In my opinion, there are “sucker’s” bets being placed in this stock right now.

Although the stock is taking a hit today…

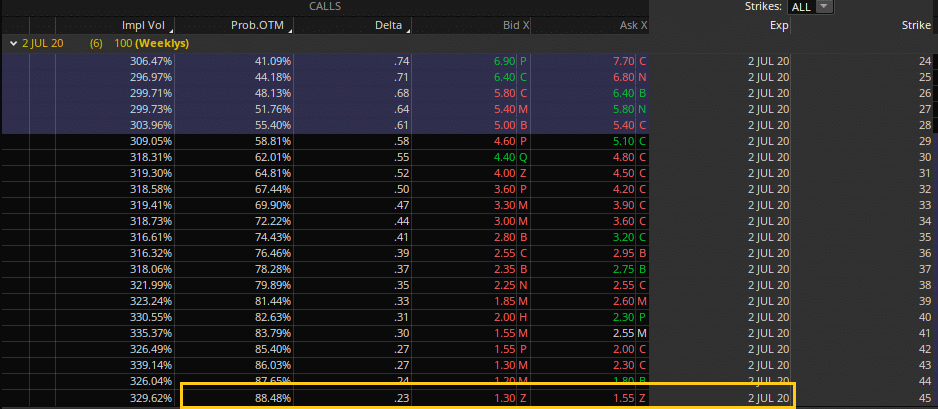

The $45 calls expiring on July 2 have a lot of value, in my opinion.

They were going for about $1.40 in the afternoon session on Friday.

Whoever buys those options would need the stock to rise by more than 50% just to break even.

For a holiday shortened-week, chances are that’s not going to happen… at least that’s what the numbers tell me on thinkorswim.

Source: thinkorswim

I mean take a look at the bid-ask spread there…

The $45 strike price INO calls expiring in just 6 days were $1.30 X $1.55.

Now, look at the very first number under “Prob. OTM” in the yellow rectangular area.

The odds of those $45 strike price calls expiring OTM was a whopping 88.48%.

In other words, there was nearly a 90% chance thoser calls expire worthless.

Can INO get above $45?

Sure…

But the odds say it’s not likely.

Now, over the long haul… if options traders continue to take these bets, I think it actually can hurt them. I mean imagine placing a trade like that every week…

The odds of winning on all of them are pretty slim.

For me personally, I like to take the opposite sides of those trades… using a risk-defined strategy.

Why?

Over time, it puts me in a position to consistently generate profits.

Now, if you’re interested in learning more about the strategy and how I actually use it to my advantage…

Then you’ll want to check out this exclusive training strategy.

In it, I reveal the “bookie” advantage and how I stack the odds to my favor.

If anything can go wrong it will. I’m 72 and my iPad went to IPad heaven I’ve been saving to get into a group but now using my iPhone and writing so small I can’t easily read it. Need the team of yours and Kyles to explain essily what I need to enter. Big writing if possible.