It’s been a wild ride for the market…and it doesn’t seem like volatility will die down just yet. In times like these, you should be looking for ways to adapt to this environment.

Sure, stocks finished strong yesterday… but that doesn’t mean you shouldn’t be looking at different strategies so you can brace yourself for another potentially volatile week.

The trade war is still on the table, even though talks have resumed… and we actually saw this similar price action last week.

If you’re having a tough time trading this market and navigating through all these headlines right now… that’s okay.

There are actually ways for you to adapt to this environment.

If you’re trading options… one quick tip is to look for further out-of-the-money (OTM) options to trade.

In other words, look for options where the strike price is further away from the stock’s current price.

Not only that, but another way to adapt is to trade a smaller position size.

If you’re used to trading 10 contracts, you could look to cut your position size to say 5-7 contracts.

That way, when the market bounces around all over the place, you can stay the course and not get chopped up.

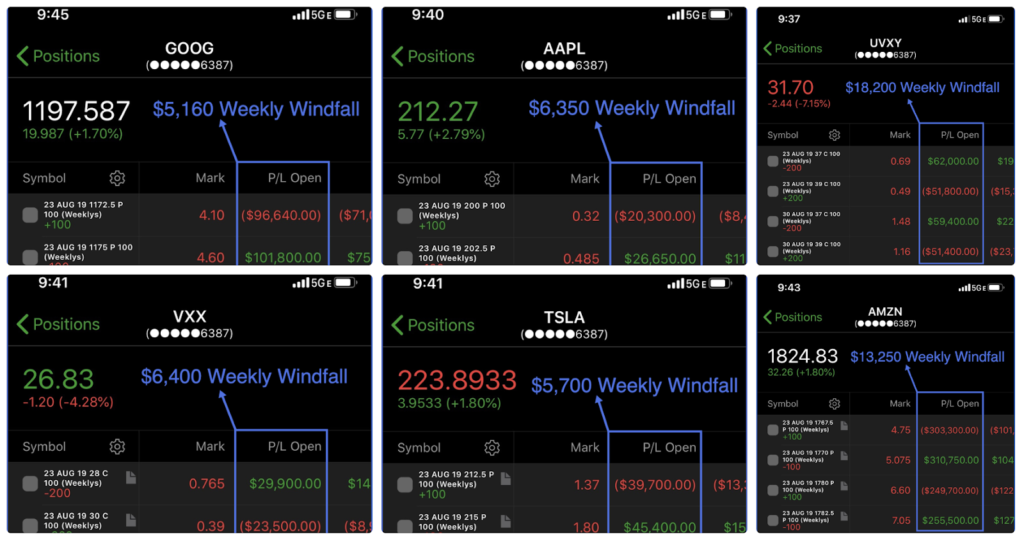

With options, if you start using those tips today… and can just find the right levels where a stock could stay above or below… you could see returns like this.

For the most part, I’m still bullish and my thesis is the U.S. and China could still come to a resolution. However, that doesn’t mean it’s been easy to trade.

So what am I watching right now?

Currently, I have some positions in large-cap names like AAPL, TSLA, BYND, NFLX and GOOG… and I’ll be keeping an eye on these… because that’s what’s been working for me.

You see, with my Weekly Windfalls strategy, I improve my chances of success right off the bat… because the only thing that I need to find is a key level.

Just as long as the stock stays above or below that level (depending on which direction I’m looking at)… I can produce massive winners (the ones you saw above) as I did less than 2 weeks ago.

For example, if you’re bullish on Apple Inc. (AAPL) and think it can stay above $200… you can place a spread trade. That means AAPL could trade sideways… or even fall slightly… and you can make money… and if AAPL rises… you’ll make money.

The only thing that you need to do is find that level… and properly manage your risk by using those quick tips I just shared with you.

Follow me on socials:

0 Comments