Growing up, I’m sure you sat there and listened to someone lecture you on the importance of education…and you might’ve sat there with your eyes rolling back and thought, “Not this talk again.”

You see, when we think about higher education… we think of those massive lecture halls, filled with some goofballs who just snicker and snarl when the professor talks… and the mountain of debt that goes along with it.

Heck, we’re often sold the dream that going to school is the key to success.

But the thing is, education doesn’t have to come in the form of a classroom and classes that you might not ever need. Instead, you can pick and choose what you want to excel at.

Don’t get me wrong though, I followed the whole higher-education path and actually received a Master’s degree in education. So I’m not knocking the whole “going to school” roadmap.

The point is, you should never stop learning… and always seek for ways to better yourself.

For example, when I was evaluating my finances with my wife, I looked through our account statements, pay stubs and stared in the eyes of the debt behemoth… and I knew we weren’t going to take it down on our salaries.

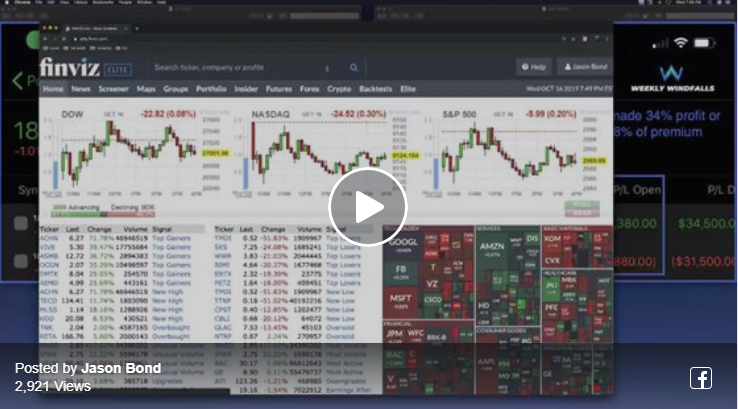

So I went out and perfected my small-cap momentum trading strategy… but like I said, we have to learn how to better performance, especially as traders.

This year, I actually developed an options trading strategy and made it so easy to understand… the best part is that it works in various market environments… even the one we’re in now.

Of course, when you’re learning something completely new to your eyes, you will have successes and failures. But for some reason, we place more emphasis on losing than winning, when it comes to trading stocks and options.

Generally, the one thing holding people back from starting trading is the fear of failure… and not living up to “expectations”.

However, it’s how we deal with failure and walk through the path of hot coals that dictates our success.

I want to leave you with an important trading lesson, one that I think could help you find high-probability setups in this environment.

0 Comments