It’s been a tough market out there for many investors and traders, and if you’ve been struggling right now, don’t beat yourself up. It’s all part of the game.

During my webinar last night, I saw so many questions flood the chat… but there was one question that stood out to me — what are traders looking at?

I kept noticing that question pop up, and that’s a signal that many traders are feeling lost. This is where I come in — to try to help as many of you as possible, I want to show you what’s working in this environment and what I’m watching at these levels.

You see, while many people are focused on the overall market and large-caps… wondering how it’ll affect their portfolios, I’ve been able to navigate the markets with ease. Not only that, but my clients have benefited from the brand new changes I’ve made to Jason Bond Picks.

How have I been able to find success in this crazy market?

Location Is Key To Finding Success In This Market Environment

Just like in real estate, location is key in the stock market. There are some areas in the market that are hotter than others right now.

For the better part of my trading career, I traded in a bull market… and it was easy pickings. However, many questioned how I would fare in a bear market. Let me tell you something, my two simple patterns have been working extremely well even with all this volatility.

Today, I want to walk you through EXACTLY how I use my bread-and-butter pattern to reel in profits consistently.

The first step is to know where to find stocks, right?

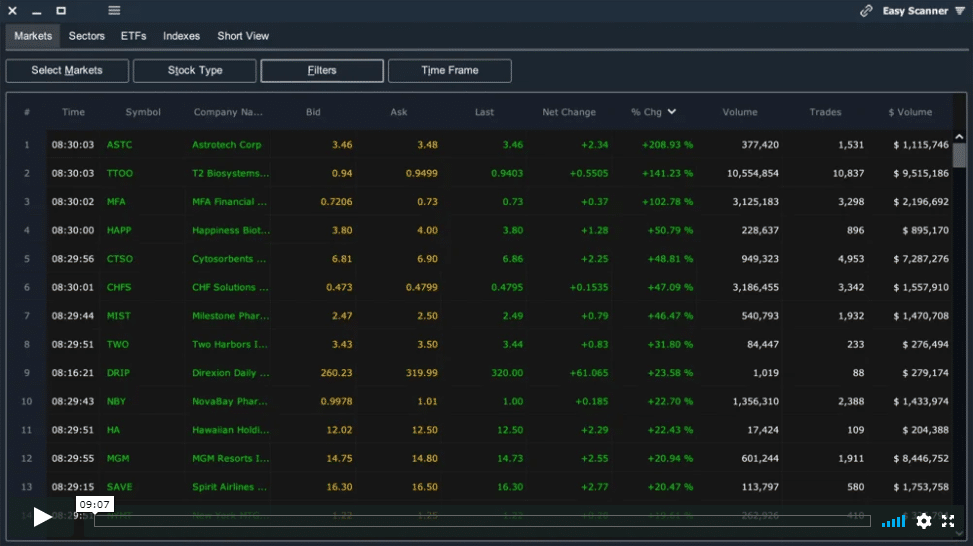

Well, I’ve come up with a scanner that picks out momentum stocks and allows me to hunt them down with ease.

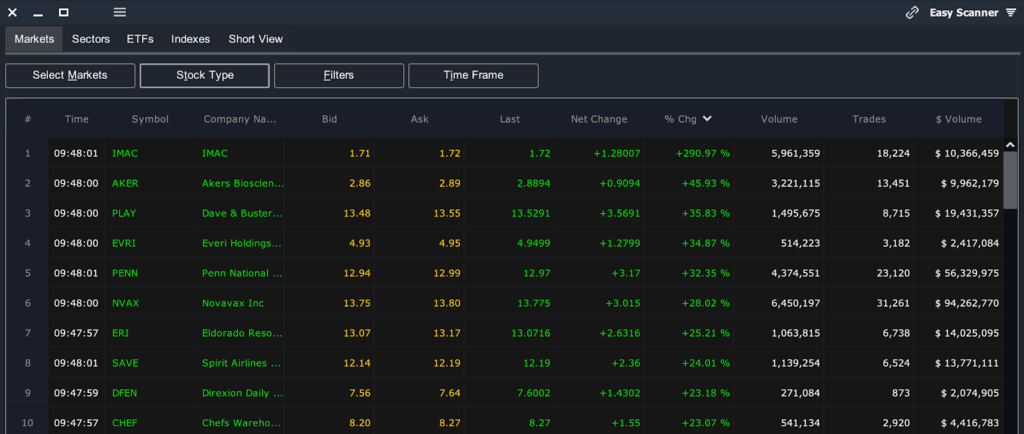

Some of the factors I filter for include:

- Market Capitalization. I only want to trade small- and mid-cap stocks.

- Volume. I want to find liquid stocks to trade

- $ Volume. I like to look for stocks with a lot of volume, in terms of the dollar value traded that day.

- Percentage Change on the day. For the most part, I want to look for stocks that are up on the day.

Pretty simple, right?

If you want to learn more about my scanner… you’ll have to gain access to Jason Bond Picks premium.

Once I filter down all the stocks out there, I further drill down my list of stocks to trade by looking at the overall chart pattern. Unless the stock exhibits one of my patterns… I’m not trading it.

Let me walk you through one of my setups in Dave & Busters (PLAY).

My Quick $6,000 Winner In PLAY

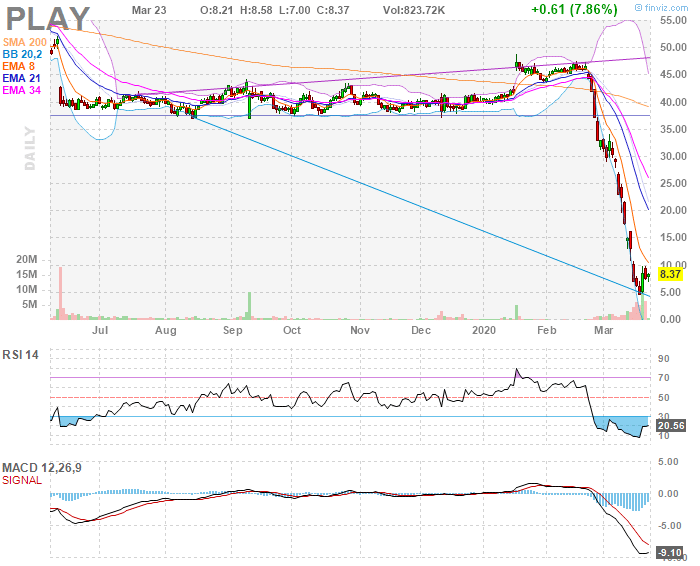

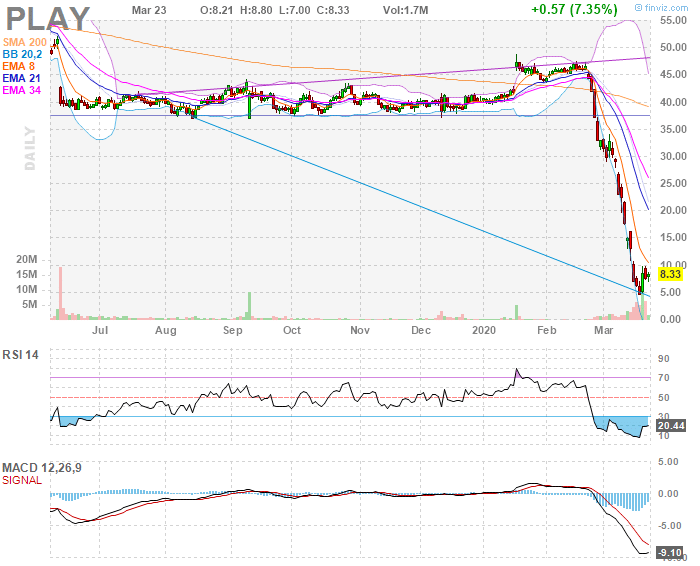

On Monday, I saw PLAY pop up on my scanner. In fact, it was third on my list… and I quickly pulled up the chart. Once I pulled up PLAY, I was so stoked because I saw my trusty fish hook pattern.

Here’s what I sent out about PLAY in Monday’s watchlist…

Finally, PLAY which I traded well last week is making a nice higher low after resting for a few days. If shares can get above $10 this really has a lot of room higher. I’m watching $8 as the pivot for now.

Once I put the stock on my watchlist, I knew I had to keep an eye on it… and Jason Bond Picks clients knew to keep it on their radar.

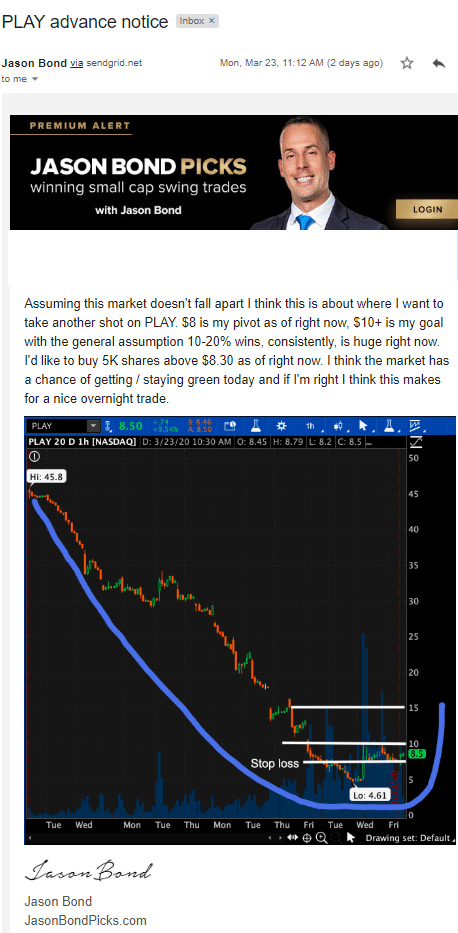

Shortly after I sent out my watchlist, I sent out an ADVANCED Notice email. That’s right, before I got into the trade… I let my clients know about my plans.

If you look at the screenshot above, you’ll notice there was an entry zone, stop-loss zone, and target area. The only thing I needed to do was follow the plan.

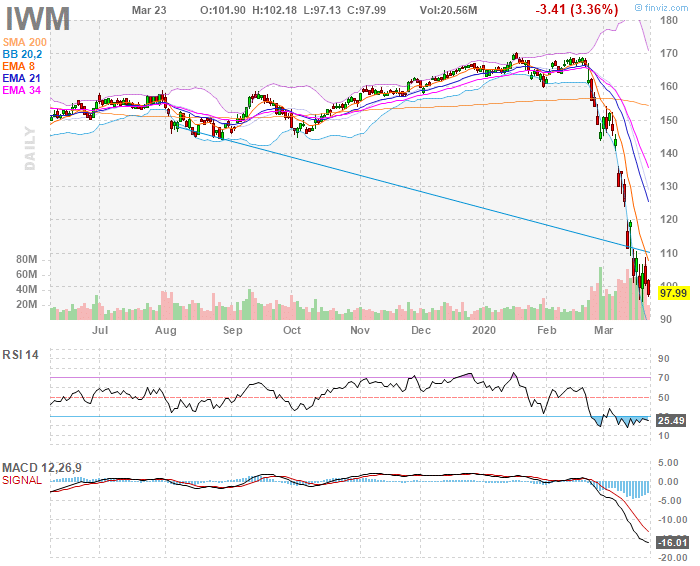

Well, shortly after I sent out the advanced notice email, I noticed PLAY was having a stellar day and was diverging with the small-cap ETF (IWM).

Here’s what I sent out to my clients in real-time — letting them know I bought shares of PLAY.

So we’re seeing some weakness in the IWM as these overall markets try hard to find a real bottom. I like the divergence in PLAY up 8% at the time of my buy. I picked up 5k at $8.35, am monitoring $8 as my probable stop loss area and am looking for a test of $10 to see how it trades at those levels. Bought into the IWM low of day move thinking if it reverses today, PLAY might see that $10 level. If not, it’s diverging so I might be able to hold onto it for a swing.

Here’s the divergence on PLAY I’m referring to, meaning it’s up as the market is down, showing signs of headed higher despite a headwind. The thesis is if the wind shifts to the back of the overall market, stocks that were diverging will go up faster. We’ll see if it works.

Just a few hours after I got into the trade… PLAY jumped up 15%, and I was able to rake in $6,000 in real-money profits!

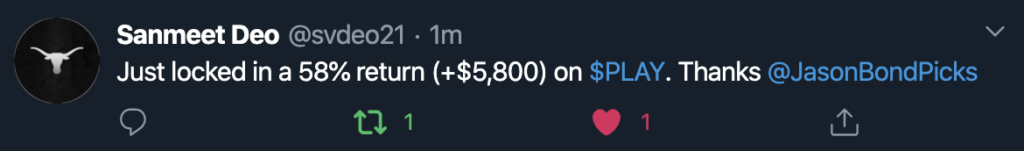

Of course, some of my clients did a heck of a lot better than me… like Sanmeet.

What’s working for me in this market environment are my patterns, finding areas of value, and catalysts. If you want to learn how to put yourself in a position to win in this market environment, click here to watch this limited-time training session.

0 Comments