It’s a shortened trading week in honor of Martin Luther King Jr. Day. Since the U.S. markets are closed today, I thought it’d be a great time to provide you with a few tips on how to find small-cap momentum stocks to trade…

And of course, I’ll provide you with 3 stocks to keep an eye on this week… I won’t keep you around too long during this holiday, so let’s get started.

For the most part, if you want to find small-cap momentum plays… all you have to do is find a few filters, such as volume, price, performance, and market-cap. For example, here are a few filters I used to find potential swing trade setups…

- Market-cap between $300M and $2B (I’m only focused on small-cap stocks here).

- Price under $10 (you can play around with the price if you want).

- Average volume over 1M (this allows us to find stocks that are liquid)

- Performance for the week up +10% (this helps us find stocks that are moving and could gain momentum).

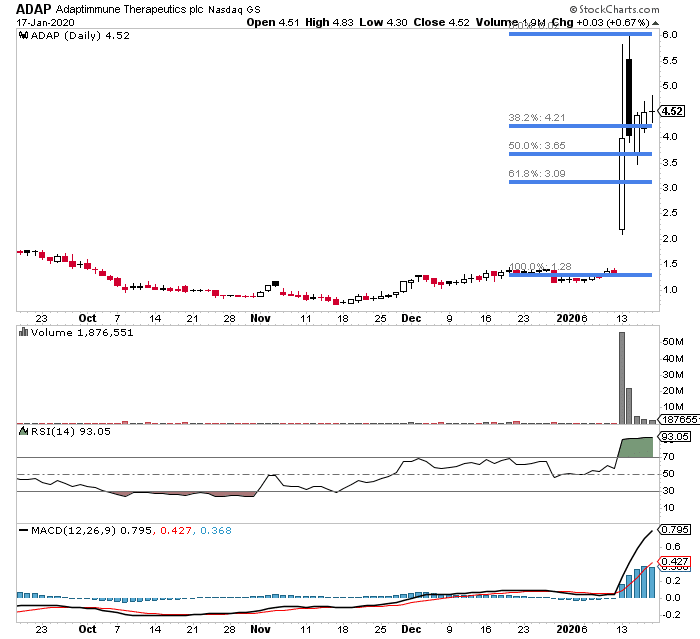

Adaptimmune Therapeutics (ADAP)

The thing is, just because you filter stocks, it doesn’t mean you go out and randomly pick one to buy. There actually needs to be context behind the trade setup.

For example, in ADAP, two of my favorite patterns came up — the rocket and the rest and retest.

If you look at the daily chart in ADAP above, you’ll notice how ADAP shot higher… and pulled back into the 50% Fibonacci retracement level, then bounced and closed relatively strong on Friday.

This stock has just about 11M shares floating, and a short interest of 13.58%, so it could squeeze higher and get back to the upper end of the range around $6.

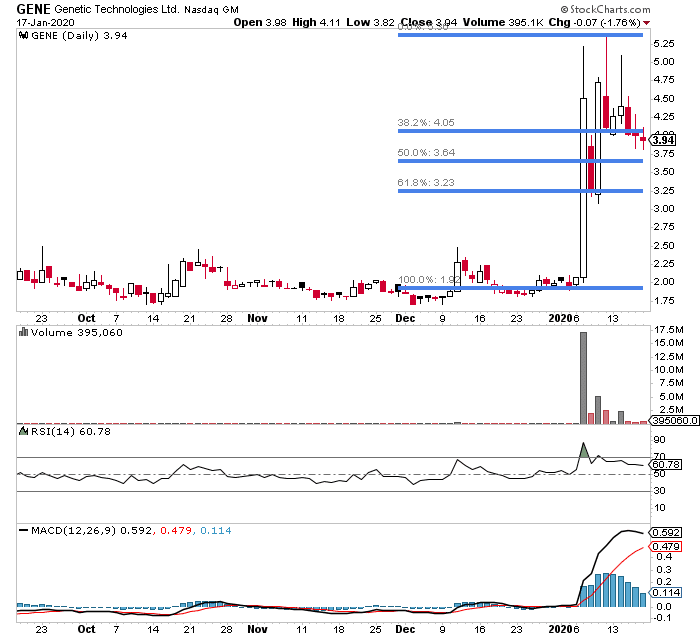

Genetic Technologies (GENE)

This is another interesting setup, and it’s very similar to ADAP. The stock rocketed higher… and now it’s got the rest and retest pattern forming.

If you look at the daily chart above, there are some key Fibonacci retracement levels to keep an eye on. The 50% and 61.8% Fib levels are key support levels, and if those hold… I wouldn’t be surprised if GENE retests previous highs.

Not only that, but this is considered a low float stock with just 5.55M shares floating. What that means is if demand kicks up, this stock could have massive percentage moves, really fast.

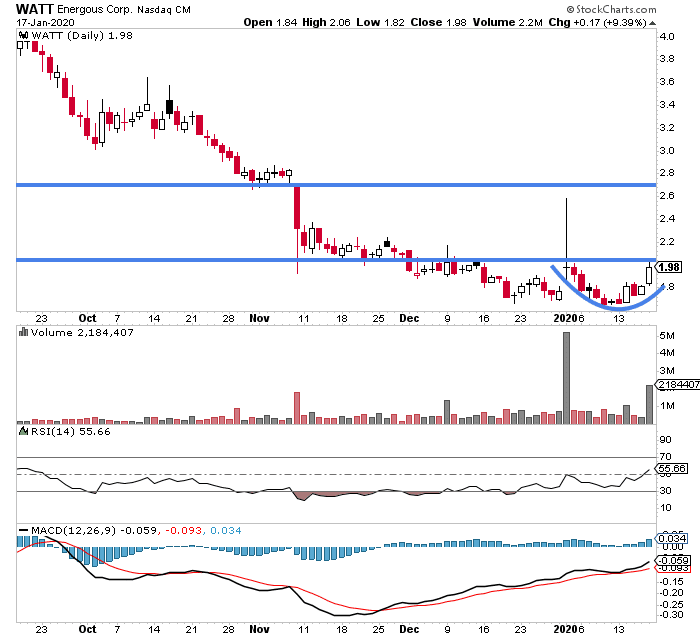

Energous Corp. (WATT)

As I was conducting one of my scans for small-cap momentum stocks… I came across one of my highest conviction 2020 Jackpot Trade ideas. This was one stock I’ve been keeping an eye on… and I finally pulled the trigger on Friday. I do have a position in this.

So let me walk you through the thought process behind this trade idea.

There was odd price action on Friday, heading into a long weekend. Not only that, but the stock has been beaten down… and that’s a sign the company could release some good news. Who knows.

But the chart pattern was very interesting and indicated it could rocket higher. In addition to that, the stock has just 26.15M shares floating and a short interest of 17.17%… so it’s a potential short squeeze play as well.

If you look at the daily chart in WATT, it’s got a nice rounded bottom pattern forming and it’s right at a key inflection point. If it breaks above $2.00, I wouldn’t be surprised if this stock has a quick 20% pop.

I’ll be keeping an eye on these 3 stocks, and of course, I’ll be sure to let my Jason Bond Picks crew know if I make any moves.

0 Comments